As airways promote fewer tickets, owing to pandemic journey restrictions or travellers’ worry of an infection, the industry that makes flying doable faces a reckoning. Aircraft-makers will make fewer passenger jets and so want fewer elements from their suppliers. Ticket-sellers will see much less customized and airport operators, decrease footfall. Many companies have lower output and laid off 1000’s of employees. The query now could be how far they will fall, how shortly they will recuperate, and what will be the long-lasting results.

The airline-industrial advanced is huge. Last 12 months 4.5bn passengers buckled up for take-off. Over 100,000 business flights a day stuffed the skies. These journeys supported 10m jobs straight, in response to the Air Transport Action Group, a commerce physique: 6m at airports, together with workers of retailers and cafés, baggage handlers, cooks of in-flight meals and the like; 2.7m airline employees; and 1.2m individuals in planemaking. In 2019 they helped generate revenues of $170bn for the world’s airports and $838bn for airways. Airbus and Boeing, the duopoly atop the plane provide chain, had gross sales of $100bn between them. For the aerospace industry as a complete they have been maybe $600bn. Add journey companies like Booking Holdings, Expedia and Trip.com, and also you get annual revenues of some $1.3trn in regular occasions for listed companies alone, supporting roughly as a lot in market capitalisation earlier than covid-19—and rising.

Taxiing occasions

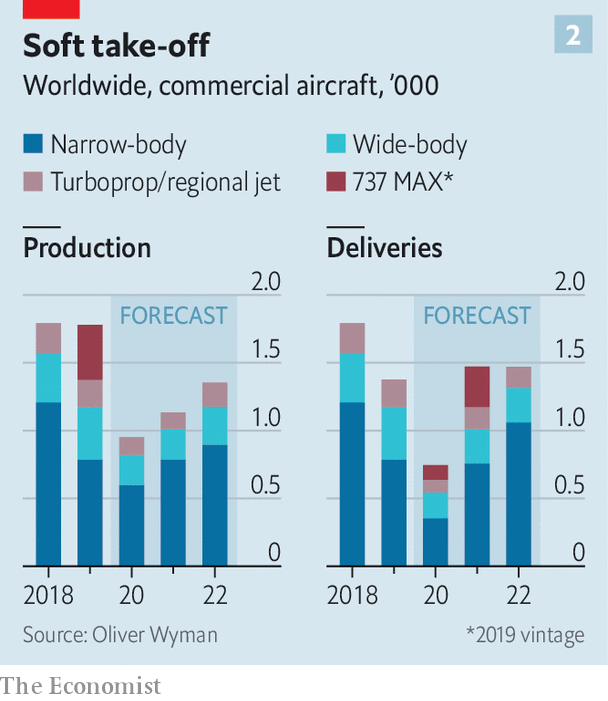

Instead, the coronavirus has lopped $460bn from this market worth (see chart 1). Airline bosses are reassessing traits in passenger numbers, which had been anticipated to double within the subsequent 15 years, simply as they’d with metronomic regularity since 1988, regardless of blips after the 9/11 terrorist assaults of 2001 and the monetary disaster of 2007-09. Rather than improve by 4% this 12 months, air-transport revenues will fall by 50%, to $419bn. After ten years of bizarre profitability the $100bn of whole losses forecast for the following two years is the same as half the nominal web income the industry raked in for the reason that second world conflict, calculates Aviation Strategy, a consultancy. Luis Felipe de Oliveira, director-general of ACI World, which represents the world’s airports, gloomily predicts that revenues there will fall by 57% in 2020.

Despite indicators of life, notably on home routes in massive markets like America, Europe and China, the outlook stays unsure. The wide-body jets used for long-haul flights stand idle. Carriers that depend on enterprise passengers and hub airports are struggling. Although some American airways anticipate a return to near-full operation subsequent 12 months, a second wave of covid-19 might sprint these hopes. A small outbreak in Beijing in June set again the restoration in Chinese home flights. As one senior aerospace government says, “It’s hardest to talk about the next 12 months.”

According to Cirium, one other consultancy, round 35% of the worldwide fleet of round 25,000 plane continues to be parked—lower than the two-thirds on the peak of the disaster in April however nonetheless horrible. Even if site visitors recovers to 80% of final 12 months’s ranges in 2021, as some optimists anticipate, loads of aeroplanes will stay on the bottom. Citigroup, a financial institution, forecasts extra capability of 4,000 plane in 18 months’ time.

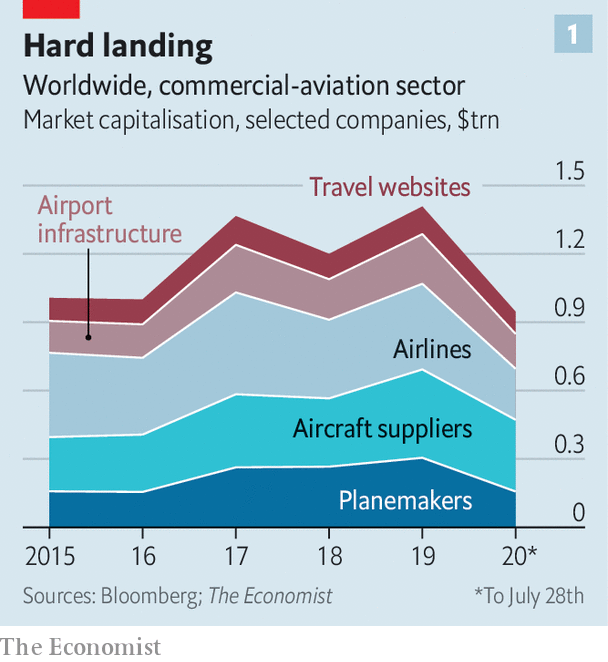

Aircraft-makers, which had been making ready to crank up manufacturing, are pressured to do the alternative. Airbus, with a backlog of greater than 6,100 orders for its A320 jets, was rumoured to be elevating output from 60 of the favored narrow-bodies a month to 70. Instead it’s making 40. Its long-haul planes have suffered comparable declines. Boeing’s scenario is made worse by the protracted grounding in 2019 of its 737 MAX, a rival to the A320, within the wake of two deadly crashes. It has saved making the plane and hopes to have it recertified for flight later this 12 months. The American agency will slowly improve manufacturing to 31 a month by the beginning of 2022. But like Airbus, it too has introduced cuts to wide-body manufacturing.

This will open a massive hole between what the pair, together with Embraer and Bombardier, makers of smaller regional jets, hoped to promote and what they really will (see chart 2). According to consultants at Oliver Wyman, by 2030 the worldwide fleet will be 12% smaller than if progress had continued unabated. That quantities to 4,700 fewer planes, which might translate to $300bn or so in forgone income for Boeing and Airbus, in response to a tough calculation by The Economist.

With so many plane sitting idle and balance-sheets in tatters, airways are eliminating planes. Even low gasoline costs will not save older, thirstier fashions. Four-engine wide-bodies are all however completed. On July 17th British Airways (BA) mentioned it could retire all 31 of its Boeing 747 jumbo jets. IBA, an aviation-research agency, expects 800 planes world wide to be retired early.

Not all orders will dry up. Airlines, in addition to leasing companies, which now personal near half the worldwide fleet, are contractually obliged to take plane on order. Many consumers will have made pre-delivery funds of as much as 40% of the value. Airbus and Boeing are, to various levels, pushing clients to take deliveries. Most negotiations have centred on deferring deliveries. EasyJet, a British low-cost service, has pushed again supply of 24 Airbuses by 5 years. At Boeing, delays associated to the issues of the 737 MAX enable airways to ask for refunds. More assertively, Airbus’s boss, Guillaume Faury, doesn’t rule out suing clients who renege on their orders.

A inventory of “white tails”, as unsold planes are identified in industry vernacular, will be the value to pay for shielding a provide chain that had been investing closely for ever-higher manufacturing charges. Airbus will make 630 planes this 12 months however ship solely 500, Citigroup reckons. It has the balance-sheet to hold stock, thinks Sandy Morris of Jefferies, one other financial institution. The new charge will protect jobs and industrial effectivity, and make an eventual ramp-up simpler.

Even this artificially excessive manufacturing will battle to maintain the planemakers’ provide chain, nonetheless. This contains producers of engines (like Rolls-Royce and GE), producers of fuselages and different elements (corresponding to Spirit AeroSystems), specialised supplies companies (Hexcel and Woodward) and firms that produce avionics and electrical techniques (together with Honeywell and Safran). And that isn’t counting their myriad smaller suppliers; Boeing’s MAX provide chain stretches to round 600 companies. Many had invested closely earlier than the disaster, anticipating robust demand. Defence contracts, which companies from Airbus and Boeing down are concerned in and which covid-19 has not likely affected, present solely partial respite. On July 29th Boeing mentioned it had delivered simply 20 planes within the second quarter, down from 90 a 12 months in the past, and that commercial-aircraft revenues had dropped by 65%, to $1.6bn. The subsequent day Airbus and Safran additionally disclosed sharp falls in income.

The engine-makers present a living proof. Besides decrease demand for his or her package—Rolls-Royce was gearing as much as provide 500 items a 12 months to Airbus however will now most likely make 250—they face a collapsing aftermarket for spares and fewer overhauls, factors out David Stewart of Oliver Wyman. Airlines with in-house upkeep divisions can scavenge elements or complete engines from grounded planes. Rolls-Royce, whose engines energy two-fifths of all long-haul jets, has suspended dividends, mentioned it could lower 9,000 jobs and brought a £2bn ($2.6bn) mortgage. It might should ask traders for an additional £2bn. GE’s second-quarter revenues from its aviation enterprise fell by 44%, 12 months on 12 months, dragging down the conglomerate’s general outcomes (see article).

At the opposite finish of the air-travel industry are airports. About 60% of their revenues comes from fees on airways and passengers, and the remainder from issues like retail and parking. All are taking a hit. Airport outlets and eating places in America will lose $3.4bn between now and the tip of 2021, forecasts the Airport Restaurant & Retail Association. As Mr de Oliveira of ACI World notes, two in three airports have been shedding cash earlier than the disaster; now all are. Some smaller ones might shut if subsidies to help tourism from regional and nationwide governments begin to dwindle. Outside America business operators haven’t been handled by governments as generously as airways have.

In July Standard & Poor’s once more downgraded the debt of 4 European airports, together with Amsterdam’s Schiphol and Zurich, and positioned London Gatwick and Rome on watch, questioning their capacity to lift fees whereas airways proceed to bleed money. The ranking company estimates a lower of €10bn ($11.8bn) in deliberate capital spending by European airports in 2020-23, which can crimp efforts to put in contactless know-how that might assist reassure travellers that terminals are protected to re-enter.

As darkish because the skies have grown for the air-travel advanced, there are some alternatives. Airlines are restructuring. Europe’s massive legacy carriers, beneath strain from low-cost rivals, are slashing prices. BA has suspended 30,000 employees and needs to rehire them on much less beneficiant phrases. Bankruptcies and cutbacks will depart gaps out there, plane are low-cost, once-scarce pilots are plentiful, and airports will have spare slots, if they’re allowed to redistribute them.

Strong challenger carriers have a probability to realize market share. Wizz Air, a Hungarian low-cost service, hopes so as to add capability by March; its major markets in central and jap Europe have been harm much less by the pandemic than these elsewhere, its clients are typically younger and fewer nervous about getting on a airplane, and two-thirds of demand is expounded to visiting household and mates, which appears extra resilient to covid-19 than enterprise journey is.

Some carriers might radically rethink their monetary buildings, which might assist leasing develop even quicker. Domhnal Slattery, boss of Avolon, a massive lessor, thinks that heavy money owed airways incur to outlive the pandemic might persuade lots of them that they needn’t personal plane however ought to as a substitute consider gross sales and advertising and marketing, simply as lodge chains have turned their backs on proudly owning property.

The industry can also be rethinking its environmental footprint. Bolder airways with stronger balance-sheets might use the disaster to resume their fleets, making them greener. They have bargaining energy: every part is negotiable, together with deferrals, prepayments and value.

Rolling with the punches

Warren East, boss of Rolls-Royce, suspects that the “pre-covid call for sustainability will come back stronger than ever”. Airbus continues to be dedicated to the journey to zero-emissions flying, Mr Faury says; he sees it as a chance. Boeing must reply to remain aggressive. European governments particularly regard it as a precedence. France’s €15bn support package deal for its aerospace sector contains a €1.5bn research-and-development fund to assist Airbus launch a zero-emissions short-haul passenger jet by 2035 (most likely powered by both biofuels or hydrogen). Mr Faury accepts that there’s much less cash to speculate. But additionally, he says, “more need”. The disaster has led to larger collaboration with suppliers that might make innovation “faster, leaner and cheaper” (although that has meant shedding 15,000 employees).

China, determined to turn into a energy in business aerospace, may even see the disruption as a strategy to velocity up entry into the worldwide market, says Robert Spingarn of Credit Suisse, a financial institution. He speculates that Brazil’s Embraer, whose merger with Boeing fell aside in April, would possibly collaborate with China’s COMAC to construct a airplane able to competing towards Airbus and Boeing. The Brazilians might provide the commercial knowhow and the Chinese the commercial would possibly.

To the masked passengers on half-empty planes, boarded from ghost-town airports of shuttered outlets, it might appear that the expertise of flying will by no means be the identical once more. Yet aviation has bounced again earlier than. It is probably going to take action once more—and will change for the higher within the course of.

Be First to Comment