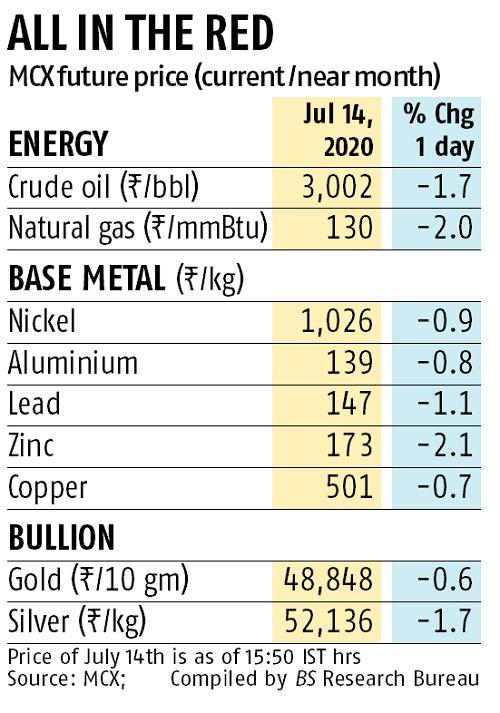

Commodity costs fell on Tuesday as rising Covid-19 cases all over the world sparked fears of a recent spherical of lockdowns and the US and China sparred over Beijing’s territorial rights within the South China Sea.

Gold, silver, oil, and copper have been among the many main losers globally and in India — on the MCX. The fall was partly arrested after the rupee tumbled in opposition to the greenback, making the import of these commodities costlier.

On MCX, crude oil and silver have been down 1.7 per cent from Monday evening’s shut, whereas gold shed 0.6 per cent. In metals, zinc and lead misplaced essentially the most.

Market consultants, nonetheless, attributed the fall to revenue reserving.

Gnanasekar Thiagarajan, director at Commtrendz Risk Management Services, mentioned: “The fall can be attributed to profit booking and some risk aversion on the back of US-China tensions.”

Despite a great value restoration in crude oil over the previous one month after Opec prolonged the output lower in June, merchants fear any partial or full lockdown will additional hamper financial restoration and hit demand for oil.

Globally, oil slipped round 2 per cent, however the fall was decrease on MCX.

Gnanasekar mentioned: “Rising virus cases, geopolitical tensions, low interest rates and an uncertainty about the US elections are all key factors providing a solid foundation for gold and silver prices to rise going forward. However, it may not be the same for metals and energy, which have been rallying purely on the back of supply problems. Still, demand is nowhere near pre-Covid levels and therefore the recent rally has the potential to fizzle out.”

California, one of the most important gasoline-consuming states in America, introduced on Monday that it will pull again on reopening efforts, the most recent purple flag for the return of oil demand. Hong Kong imposed its strictest social-distancing measures but and Japan mentioned a brand new state of emergency is feasible if infections improve.

Crude’s drop was half of a broader downward transfer in markets, as the financial hit of rising virus cases continues to develop.

Broader sentiment was boring after the United States rejected China’s disputed claims in most of the South China Sea, with US Secretary of State Mike Pompeo saying Beijing’s claims have been “completely unlawful”.

“The physical premium in China has risen this week, suggesting this is a short-term correction as demand remains firm and the concerns about disruption in Chile are real,” mentioned commodities dealer Anna Stablum of Marex Spectron.

Be First to Comment