As a lot as 90 per cent of personal fairness and enterprise capital investors envisage a decline in fund-raising actions over the subsequent 6-12 months on account of the Covid-19 pandemic, in response to a Crisil Research survey report.

Though the market is sitting on enough un-invested capital or ‘dry powder’, enticing funding alternatives are seen as tough to seek out in the present setting.

About 58 per cent surveyed count on current funding worth to decline over the approaching 12 months. However, about half of them see a reasonable restoration past the 12-month horizon.

More than three-fourths of the respondents see an increase in mergers and acquisitions exercise (M&As) in the 1-2 years. This comes as exit choices would proceed to be restricted given the pandemic-led uncertainty in development. PE and VC funds could decide to remain invested longer to attain desired returns.

“With exit options limited because of the weak capital market and low interest in secondary transactions from other funds, investors would look at M&As as a strategic route to check out. M&A transactions with stronger players would be the more-likely option subject to demand contours and growth opportunities, the extent of synergy, and availability of capital for acquisition,” stated Rahul Prithiani, director, Crisil Research.

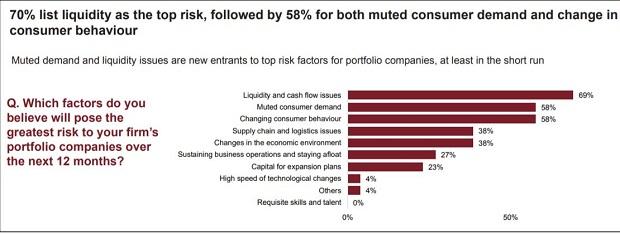

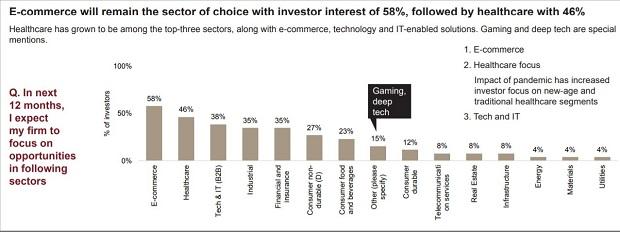

E-commerce will stay the sector of selection with investor curiosity (58 per cent), adopted by healthcare (46 per cent) and B2B tech and IT (38 per cent). Liquidity points (70 per cent), muted demand and altering client behaviour (58 per cent every) have been listed as the highest threat components for portfolio firms of investors no less than in the subsequent 12 months.

The survey was performed between May and June this yr and the credit standing agency acquired responses from 26 unbiased funds and respondents.

PE-VC investments have grown to $40 billion from $15 billion in fiscal 2015 in fiscal 2020. The FY2020 investments figures would have been even increased, had February and March not been pandemic-hit, in response to the report. Investments declined 45 per cent in February and 70 per cent in March, over the typical month-to-month investments in the previous three fiscals.

Be First to Comment