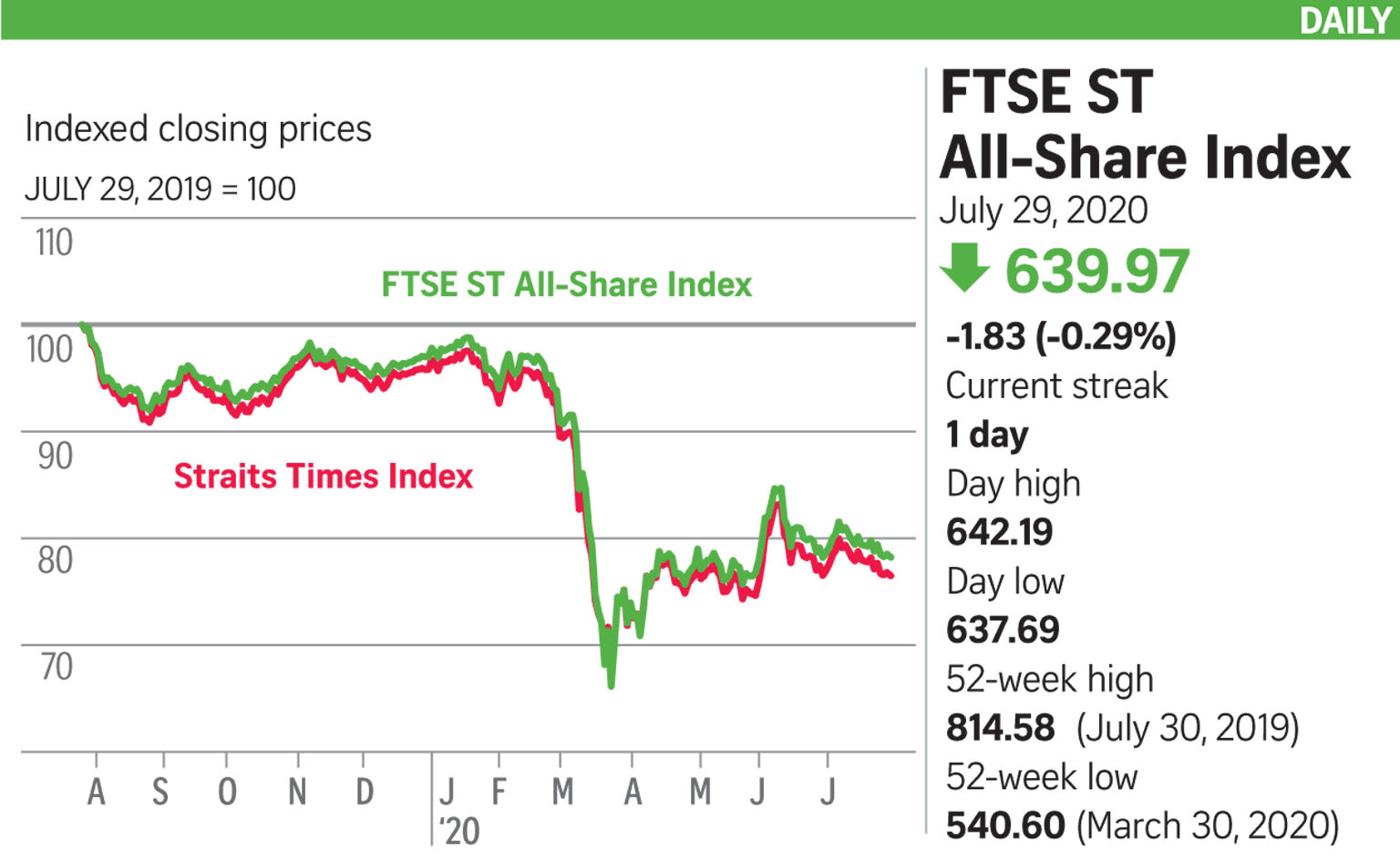

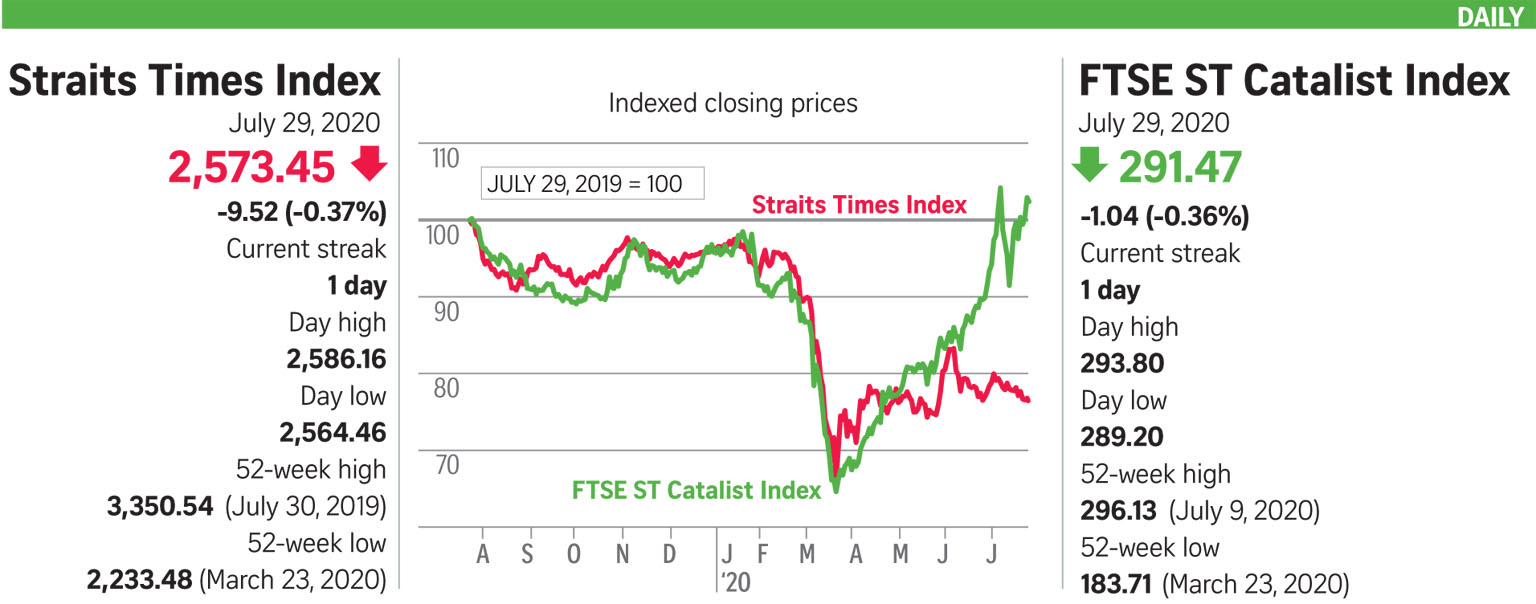

Muted trading continues amongst Singapore’s blue chips, with the Straits Times Index (STI) down 9.52 factors, or 0.37 per cent, to 2,573.45.

Losers outnumbered gainers 215 to 185, after about 1.33 billion securities price $1.29 billion modified arms.

The largest losers on the index had been CapitaLand Mall Trust and CapitaLand Commercial Trust, which respectively misplaced 3.98 per cent to $1.93, and a couple of.89 per cent to $1.68, after their second-quarter earnings final week confirmed that they had been clearly present process pressure on account of Covid-19.

The largest gainer was Venture Corporation, which rose 3.58 per cent to $17.94. It was among the many 4 most defensive shares within the first half of this 12 months, mentioned the Singapore Exchange (SGX), as expertise and healthcare counters likewise propelled international indices from January to final month.

Bolstered by a constant quantity of internet institutional shopping for, Venture has additionally proven optimistic momentum in its share value, and beat consensus estimates for the quarter resulted in March, SGX mentioned. It is because of launch its first-half outcomes on Aug 7 after market hours.

The most energetic counter of the day was Catalist-listed IPS Securex, which added 12.7 per cent to $0.124, using on the optimism of final week’s revenue steerage, through which it had mentioned that it expects to report a internet revenue for the monetary 12 months ended June 30, a turnaround from an audited internet loss for FY2019. This was because of an enchancment in income because of the earnings recognition of extra tasks accomplished through the 12 months, in addition to continued cost-control measures on the company degree.

The efficiency of regional markets was blended. Hong Kong’s Hang Seng Index added 0.45 per cent, whereas China’s benchmark Shanghai Composite Index jumped 2.06 per cent and the Shenzhen Composite Index rallied 2.90 per cent.

South Korea’s benchmark Kospi climbed 0.27 per cent - their highest shut since late January.

But Japan’s benchmark Nikkei 225 slid 1.15 per cent because the yen rose. Malaysia’s KLCI added 0.09 per cent. Analysts mentioned markets would battle to construct on the sturdy positive aspects seen since their March backside.

“There’s enough stimulus and support in the market from a monetary policy perspective, but also from fiscal, and that keeps a nice floor under the market,” mentioned Ms Amanda Agati at PNC Financial Services Group.

“But we also think it’s going to be very difficult to make a lot of forward progress in this environment.”

Be First to Comment