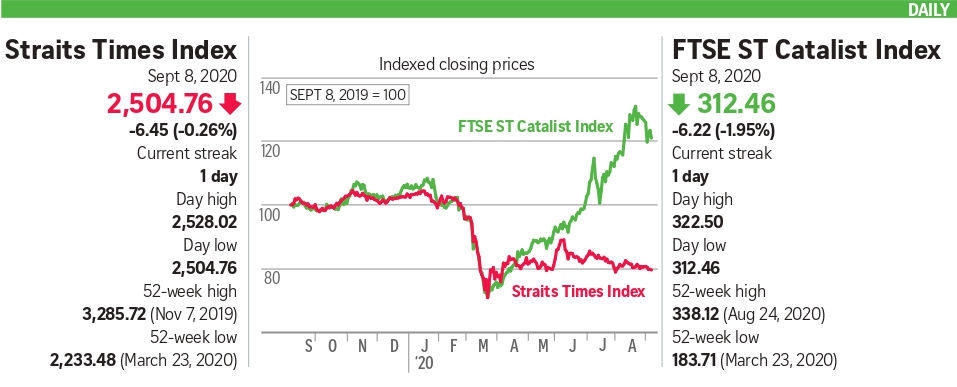

Gloomy economic forecasts from right here and around the globe despatched native shares sliding yesterday.

The sell-off left the benchmark Straits Times Index (STI) at 2,623.67, down 25.23 factors or 0.95 per cent.

All however 5 of its 30 parts closed decrease whereas throughout the broader market, losers thumped gainers by 349 to 145. There have been 1.49 billion shares price $1.05 billion traded.

Genting Singapore was within the highlight after its Resorts World Sentosa (RWS) introduced it will be shedding a big variety of workers. The prospect of price financial savings did nothing to carry investor sentiment, although.

RWS reopened to guests early this month, however journey restrictions and secure distancing make it unlikely that enterprise will enhance rapidly.

Genting Singapore ended the day at 76.5 cents, down 2.55 per cent. It was the worst-performing STI element inventory for the day.

Monetary Authority of Singapore (MAS) managing director Ravi Me-non warned there may be substantial uncertainty over the worldwide economic outlook, and restoration won’t come rapidly. He added yesterday that MAS is in talks with the native banks on capital-management points, which can embody dialogue over a restriction of dividend funds.

DBS ended down 1.28 per cent whereas OCBC Bank and United Overseas Bank every misplaced about 1 per cent.

Among the smaller caps, Top Glove had a troublesome day after the United States authorities barred the import of its merchandise, probably over a violation of labour guidelines. The inventory ended at $6.49, down 11.1 per cent.

Other healthcare shares which have charted sturdy positive aspects in current months have been additionally weaker. UG Healthcare misplaced 14.Three per cent to $1.32, whereas Riverstone closed at $3, down 2.Three per cent, and Medtecs International dived 19.Four per cent to 52 cents.

Elsewhere, the International Monetary Fund warned that the speed of chapter for small and medium-sized companies throughout 17 nations that it has studied might triple to 12 per cent this 12 months, versus Four per cent earlier than the pandemic.

Key markets across the area have been additionally broadly softer yesterday.

In specific, Shanghai shares have been down 4.5 per cent whereas the Hang Seng misplaced 2 per cent. South Korea’s Kospi Index closed 0.82 per cent decrease because the central financial institution saved charges unchanged. Japan was 0.76 per cent down and Australia ended flat.

“No matter how much stimulus and fiscal sugar you try to entice consumers with, they will not… go on a spending spree until they feel confident the landscape is virus-free,” AxiCorp’s chief world market strategist Stephen Innes instructed Agence France-Presse.

Be First to Comment