Boeing’s income plunged 25 p.c within the second quarter in comparison with a yr in the past as it contended with ongoing fallout from the grounding of the 737 Max and the devastating aviation slowdown introduced on by the coronavirus pandemic. The decline contributed to a quarterly lack of $2.Four billion.

“These past few months have been unlike anything we’ve seen,” Boeing’s president and chief government, Dave Calhoun, mentioned in a message to employees. “The pandemic’s effect on our communities and industry is ongoing. And the challenges we face as a company are still unfolding.”

The pandemic has dealt an enduring blow to Boeing’s airline prospects. Delivery of economic airplanes fell to 20 for the quarter from 90 a yr earlier. Commercial income plummeted 65 p.c to $1.6 billion. Boeing mentioned its authorities, protection and house applications helped to offset the difficulties confronted by its business enterprise, which had contributed to a call through the quarter to chop about 16,000 staff worldwide. In the message to staff on Wednesday, Mr. Calhoun warned that extra cuts might come.

“The prolonged impact of COVID-19 causing further reductions in our production rates and lower demand for commercial services means we’ll have to further assess the size of our work force,” he mentioned.

The report got here a day after a worldwide airline trade group, the International Air Transport Association, downgraded its forecast for when income will return to regular, blaming poor virus containment within the United States and different creating economies, a gradual rebound for enterprise journey, and low client confidence. Now, passenger visitors isn’t anticipated to return to final yr’s ranges till 2024, led first by home flights, it mentioned.

Boeing on Wednesday additionally pushed again its timeline for ramping up manufacturing of the 737 household of planes, together with the troubled 737 Max jet, which has been grounded since March 2019 following two deadly crashes. Boeing says it expects to succeed in a manufacturing fee of 31 of the 737 Max planes per thirty days by the start of 2022. That is about half the speed Boeing had focused earlier than the Max was grounded.

The Max inched nearer to flying once more in latest weeks, after the Federal Aviation Administration concluded a sequence of check flights and mentioned it was near formally proposing modifications that might handle its security issues. As a consequence, the Max might begin flying passengers once more towards the top of the yr or early subsequent yr, in accordance with analysts.

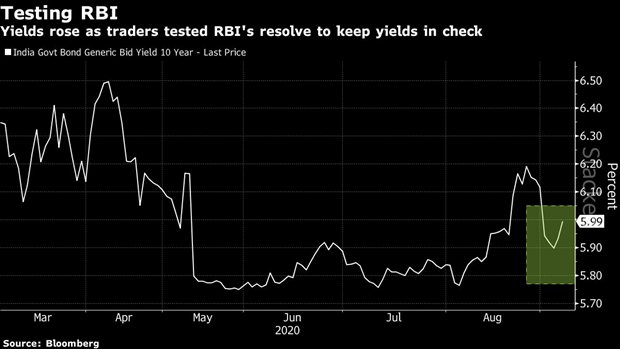

Federal Reserve officers on Wednesday will conclude a two-day coverage assembly that’s prone to yield little motion — charges are already at near-zero and are virtually sure to remain there for an prolonged interval — however might present a contemporary learn on how policymakers are fascinated with the financial outlook, and hints about their plans for the longer term.

On Tuesday the Fed prolonged its emergency lending applications via the top of 2020, a three-month addition that, whereas not shocking, signaled how lasting the financial harm from the coronavirus is proving.

The chair, Jerome H. Powell, who will maintain a distant information convention at 2:30 p.m., is certain to subject questions on the newly prolonged applications, which had been launched to attempt to preserve markets functioning and credit score flowing.

The Fed took unprecedented actions in March and April to offer a primary line of protection for the financial system as coronavirus instances swept the nation and shut down total enterprise sectors. Most of the 9 applications had been set to run out on or across the finish of September, proof that officers anticipated that ordinary situations may return by fall.

That optimism has been upended by a surge in new infections, which has continued to depress financial exercise. While state and native economies have reopened, many have needed to roll again or delay their plans, and consultants warn that the state of affairs might take a flip for the more severe if the virus takes maintain extra deeply.

The fallout of the worldwide coronavirus pandemic has pulled Hong Kong’s financial system additional into decline over the previous three months, with the Chinese territory on Wednesday reporting a 9 p.c contraction.

Hong Kong has been dealt further financial blows alongside the virus, together with monthslong anti-government protests final yr and a bruising commerce battle between China and the United States that has dampened commerce within the metropolis.

Wednesday’s disappointing financial information confirmed a slight easing from January when the federal government reported financial development dropped by probably the most in additional than 4 a long time. Nevertheless, it marked the fourth quarter of financial decline for the worldwide monetary hub battered by protests and a public well being disaster that has weighed on client spending, tourism and commerce.

The information comes as town is coping with one other lockdown extra extreme than these prior to now, as well being authorities battle to include and hint new virus instances. It additionally stands in distinction to optimistic financial information from mainland China, the place heavy infrastructure spending helped to drag the world’s second greatest financial system out of its first contraction in practically a half-century. Earlier this month, China reported its financial system expanded by 3.2 p.c over the three months ending June.

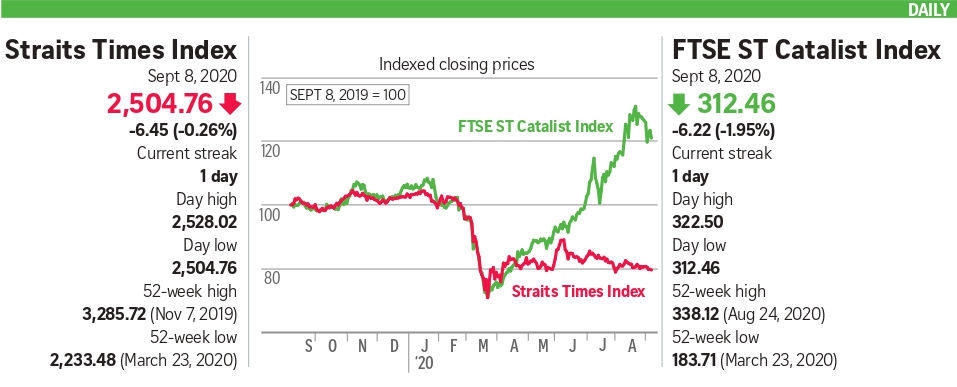

Global markets had been combined on Wednesday, and Wall Street futures had been pointing to a small upswing when buying and selling begins, as traders waded via quite a lot of company earnings experiences whereas ready for the U.S. Federal Reserve policymakers to announce the outcomes of their assembly later within the day.

European markets had been led by France’s CAC 40, which was 0.7 p.c increased by midmorning. Asian markets had a principally optimistic day.

The yield on the U.S. 10-year Treasury notice rose and oil futures gained, with Brent crude reaching $43.89 a barrel, up practically 1.Four p.c. Gold, which practically reached $2,000 an oz. earlier this week, was flat, at $1,958.

Among the European corporations reporting quarterly earnings on Wednesday had been Deutsche Bank (down 1.9 p.c regardless of a surge in buying and selling income), Barclays (down 4.5 p.c after a web loss that it attributed to the pandemic) and the luxurious group Kering, the mother or father firm of Gucci (which gained Four p.c after a smaller-than-expected drop in gross sales).

Later on Wednesday, the Fed will difficulty an announcement marking the completion of its two-day assembly. The get-together is prone to yield little motion — charges are already at near-zero — nevertheless it might present a contemporary learn on how Fed officers are fascinated with the financial outlook, and hints about their plans for the longer term.

Hong Kong’s Hang Seng index gained 0.5 p.c for the day, China’s Shanghai Composite jumped 2.1 p.c and the Nikkei in Japan fell 1.2 p.c.

In Hong Kong, after the markets closed, the federal government reported that the territory’s financial system contracted 9 p.c within the second quarter from a yr in the past, the fourth consecutive quarter of declines.

On Thursday morning, when the Commerce Department pronounces the nation’s second-quarter financial output, the information is prone to mirror the largest decline within the 70-plus years that such statistics have been compiled. But you may even see two extensively completely different numbers.

Forecasters anticipate the report to indicate that gross home product — the broadest measure of products and companies produced — fell at an annual fee of about 35 p.c. That doesn’t imply, nonetheless, that the financial system shrank by greater than a 3rd in a mere three months.

The United States has historically reported the determine as an annual fee — that’s, how a lot the financial system would develop or shrink if the change had been sustained for a full yr. But when annual charges are utilized to short-term modifications, the outcomes may be deceptive.

For that cause, The New York Times plans to emphasise the nonannualized proportion change in its protection. And on that foundation, if the forecasters are on the right track, the G.D.P. needs to be about 10 p.c decrease within the second quarter than within the first.

Here are a number of the huge tales from Tuesday:

-

Universal Pictures and AMC Entertainment, the No. 1 film chain on this planet, reached a deal to permit motion pictures to maneuver to houses after a mere three weeks in theaters within the United States, virtually actually altering the best way that Hollywood does enterprise.

-

L Brands, the proprietor of Victoria’s Secret and Bath & Body Works, mentioned that it will lay off 850 associates at its headquarters in Columbus, Ohio, or 15 p.c of employees there, as it really works to separate the manufacturers into two stand-alone corporations and handle gross sales drops tied to the coronavirus outbreak.

-

The Trump administration mentioned that it will prolong a $765 million mortgage to Eastman Kodak Company to start producing crucial pharmaceutical parts, in an effort to allay American dependence on international international locations for important medicines.

-

Global same-store gross sales at Starbucks plunged 40 p.c within the three months that resulted in June from the identical interval final yr due to retailer closures, shortened working hours and fewer prospects within the wake of the coronavirus pandemic.

-

Fraudsters could have obtained a whole lot of tens of millions of {dollars} in loans from a catastrophe mortgage program meant to assist small companies devastated by the coronavirus pandemic, the Small Business Administration’s inside watchdog mentioned.

Big retailers have made sturdy statements not too long ago about their new guidelines requiring prospects to put on face masks when purchasing, saying that the well being of their staff and prospects is paramount.

But in terms of imposing these mandates, the businesses are taking a decidedly hands-off method, writes Michael Corkery:

Walmart has advised staff that they need to not stop a buyer from coming into the shop in the event that they refuse to put on a masks. Walgreens mentioned that “for the safety of our team members” the corporate wouldn’t bar prospects with out masks from its shops. Lowes additionally mentioned it will “not ask our associates to put their safety at risk by confronting customers about wearing masks.”

Many customers and staff say the retailers’ reluctance to police their prospects’ masks carrying finally renders the brand new guidelines toothless and can perpetuate the unfold of the coronavirus. And staff discover themselves thrust onto the entrance line of a cultural and political battle over masks that may result in ugly confrontations and, at instances, violence.

Last weekend, two episodes stood out: In one, a video of an altercation involving two customers in Walmart carrying masks with a Nazi swastika went viral, whereas a person was arrested after an incident in a Walmart in Palm Beach County, Fla., through which he pulled a gun on one other shopper who had requested him to placed on his masks.

Some customers say the retailers are taking the straightforward method out by asserting masks insurance policies that aren’t true mandates. But retailers are possible on strong authorized floor if they do not want service to somebody refusing to put on a masks, particularly if they provide other ways for purchasers to buy, such as residence supply and curbside pickup.

General Motors suffered a loss within the second quarter as the coronavirus pandemic took a heavy toll on its operations in most areas of the world.

The automaker misplaced $800 million as its second-quarter income was greater than halved, to $16.eight billion in contrast with $36.1 billion in the identical interval a yr in the past. The firm used $9 billion in money through the quarter however nonetheless has $28.Three billon readily available.

In North America, which generates the majority of G.M.’s revenue, new car deliveries fell 36 p.c to 565,000 vehicles and light-weight vans. The pandemic compelled the corporate to halt manufacturing in North America for 2 months, and depressed purchases of latest autos by each customers and fleet prospects like rental-car corporations.

Its smaller South American unit suffered a fair harsher blow, as deliveries fell 65 p.c within the quarter, to 57,000 autos. In China, the place the virus outbreak has receded sooner than within the United States, deliveries fell 5 p.c.

Be First to Comment