Shares in Singapore fell alongside these in most Asian fairness markets yesterday, following a surge in global coronavirus cases.

Optimism from hopes of a vaccine and the European Union restoration fund, which fuelled Tuesday’s positive factors, was dented by US President Donald Trump’s feedback on the gravity of the pandemic.

He stated the Covid-19 pandemic in the United States will “get worse before it gets better” because the nation registered greater than 140,000 deaths from the virus.

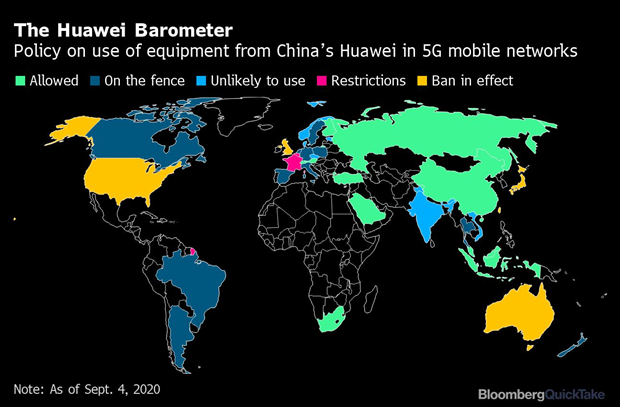

OCBC Investment Research stated US Secretary of State Mike Pompeo’s feedback - that the US needs to construct a global coalition to counter China - additionally weighed on the markets; he accused China of exploiting the pandemic to additional its personal pursuits.

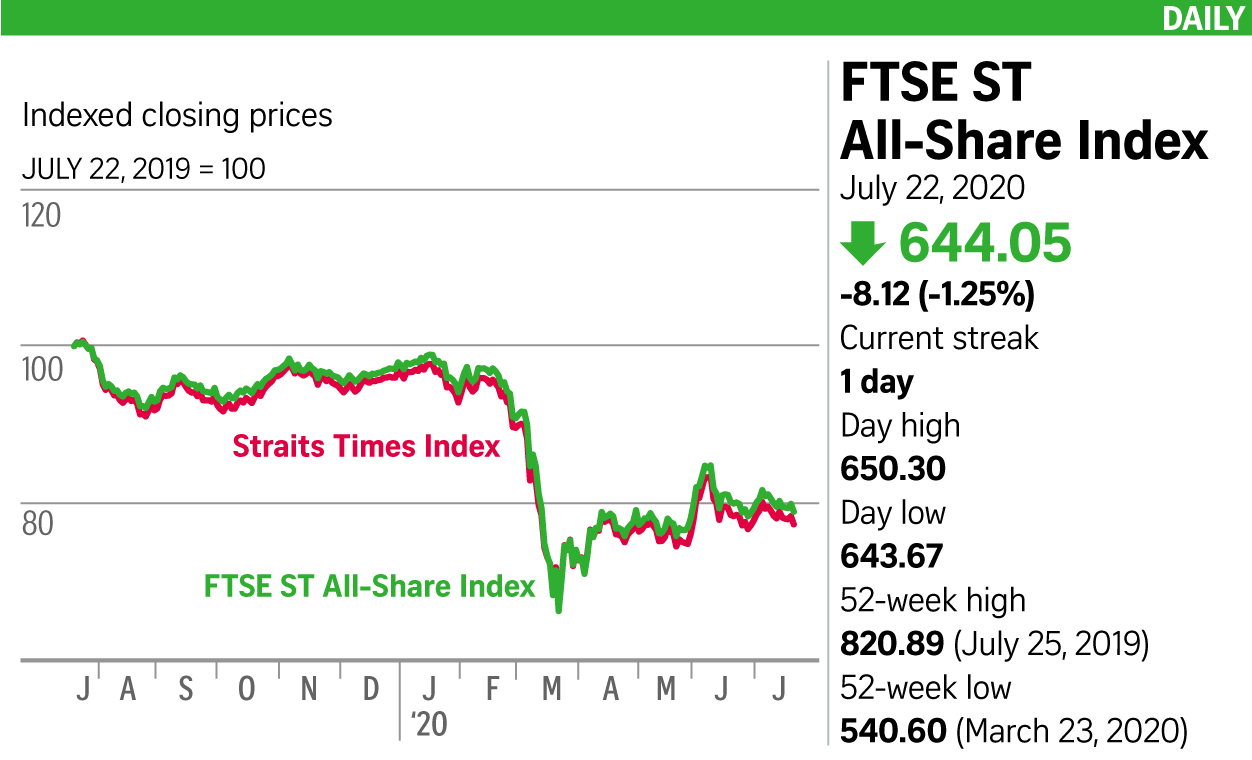

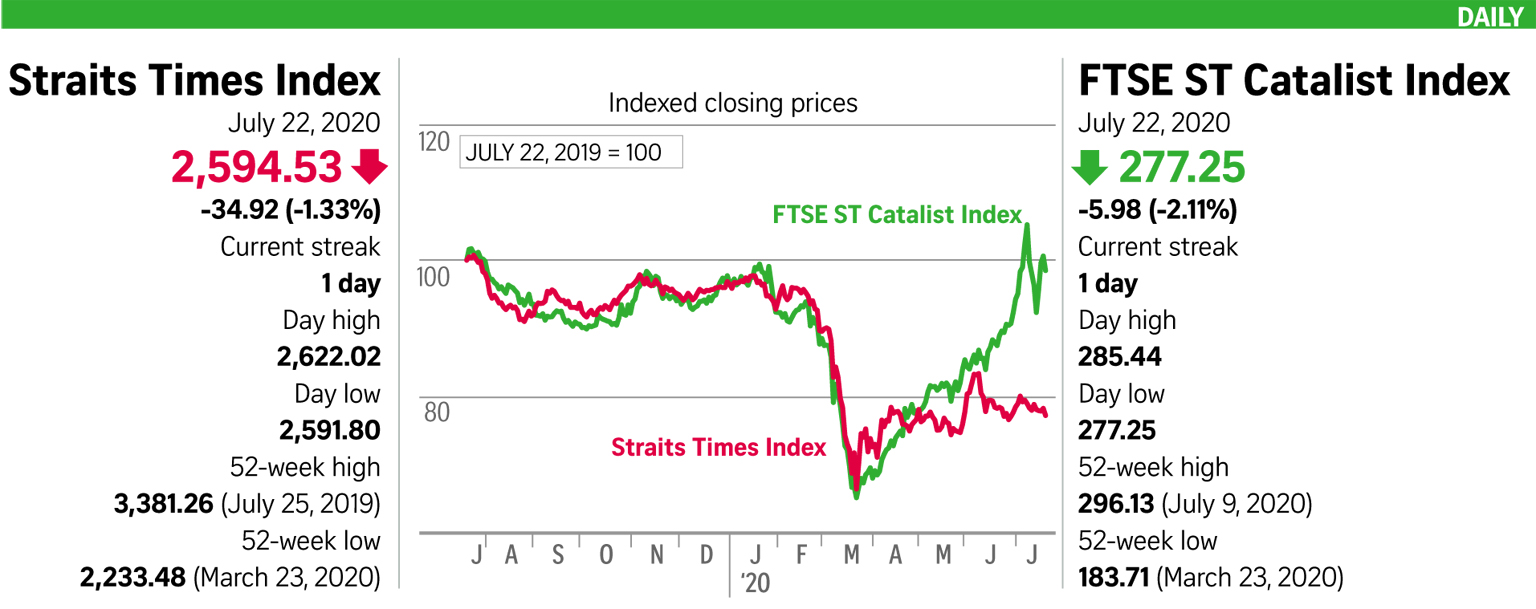

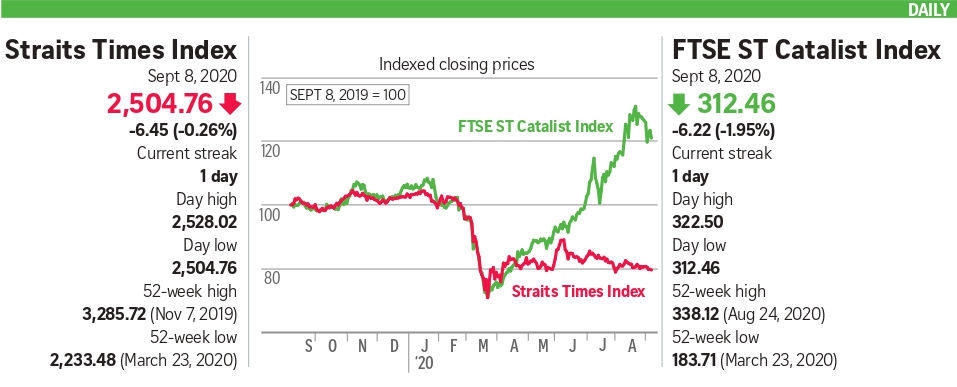

The Straits Times Index (STI) fell 34.92 factors, or 1.Three per cent, to 2,594.53. Decliners outpaced advancers 314 to 163, as 1.55 billion shares price $1.15 billion modified arms.

None of the 30 STI constituents registered positive factors for the day. CapitaLand Commercial Trust, CapitaLand Mall Trust, Genting Singapore and Mapletree Industrial Trust ended the day unchanged.

At the underside of the STI desk have been Dairy Farm International, which fell 3.Four per cent to US$4.26, and Singtel, which declined 2.Four per cent to $2.48.

Thai Beverage remained essentially the most closely traded counter, with greater than 41 million shares altering arms. Its shares fell 2.Three per cent to 64.5 cents, leaving the counter among the many STI’s backside three.

Local lenders ended the day decrease, following a DBS Group Research report after buying and selling hours on Tuesday that had stated dividend cuts by Singapore banks could occur “as early as” the upcoming payout to be introduced for the second quarter.

DBS fell 1.5 per cent to $21.08, UOB declined 1.Four per cent to $20.40, and OCBC Bank slipped 1.Four per cent to $9.80.

Elsewhere in the area, South-east Asian inventory markets wavered by way of the session, with buyers on edge as US lawmakers struggled to agree on phrases for extra fiscal help for the economic system.

Hong Kong shares fell essentially the most in practically six weeks, as indicators of escalating Sino-US tensions weighed on market sentiment. At the shut of commerce, the Hang Seng index was down 2.25 per cent at 25,057.94, its largest fall since June 11.

Be First to Comment