Here’s what you want to know:

The United States funds deficit grew to a document $864 billion in June because the federal authorities continued pumping cash into the economic system to prop up employees and companies affected by the coronavirus pandemic, the Treasury Department said on Monday.

The deficit was pushed largely by authorities spending associated to the Paycheck Protection Program, which by the tip of June had permitted greater than $500 billion loans to assist small companies. Over all, authorities outlays topped $1.1 trillion {dollars} final month, whereas receipts have been down sharply as a results of tax funds which were deferred till mid-July.

The month-to-month deficit was the biggest since April, when it hit a document hole of $738 billion. For the fiscal 12 months to date, the federal government is producing crimson ink at a document clip. So far in fiscal 2020, the deficit is $1.99 trillion, a 267 % enhance from 2019.

The figures underscore the deep fiscal gap dealing with the United States because it copes with a pandemic that has thrown thousands and thousands of individuals out of labor and shuttered companies, leading to a surge of bankruptcies across the nation.

The swelling deficit, whereas anticipated, may additional complicate talks for one more rescue bundle given Republicans’ considerations in regards to the monetary tab. Lawmakers are making ready to resume negotiations over one other spherical of fiscal assist because the virus stays resurgent in lots of components of the United States.

Trump administration officers have been calling for a payroll tax lower, a capital-gains tax vacation, extra focused aid to industries which were hit hardest by the pandemic — akin to journey and tourism — and one other spherical of stimulus checks.

The subsequent invoice may price $1 trillion to $Three trillion.

KFC, the fried rooster chain, closed eating rooms in all 40 of its corporate-owned eating places in Florida on Monday as coronavirus instances within the state continued to skyrocket.

The firm inspired franchisees working shops in Florida and different virus “hot spot states” akin to Arizona, California and Texas to comply with go well with. Corporate-owned places in Florida will proceed to provide drive-through, perform and supply the place accessible.

“This guidance is part of our continued efforts to prioritize the health of our team members, customers, and the communities where they live and work,” stated a consultant for KFC.

On Sunday, Florida reported greater than 15,000 new instances, the best single-day complete of recent coronavirus instances by state because the begin of the pandemic. The state reported greater than 12,000 new instances on Monday.

The pandemic has hit the restaurant business notably exhausting, many quick meals chains have managed to keep afloat by counting on drive-through gross sales. McDonald’s delayed reopening eating rooms earlier this month as coronavirus instances surged throughout the nation.

KFC is a subsidiary of Yum Brands, which owns different quick meals chains together with Pizza Hut and Taco Bell.

Hong Kong Disneyland will reclose on Wednesday to adjust to a government-directed rollback of public actions within the area following an increase in coronavirus infections, the Walt Disney Company stated on Monday. Disney known as the closure of the theme park “temporary” and stated its resort resorts on the Lantau Island complicated would stay open.

In closing the Hong Kong outpost once more, Disney is complying with new authorities restrictions on eating places, gyms, nightclubs, mahjong parlors and different companies.

Over the weekend, Disney executives in Florida had cited the sleek reopening of Hong Kong Disneyland and different Disney parks in Asia as proof that Walt Disney World may reopen safely, at the same time as coronavirus cases in Florida surge.

Hong Kong Disneyland, which is partially owned by the native authorities, initially closed due to the virus on Jan. 26. It reopened on June 18 with restricted capability and different security measures, together with temperature checks for guests and workers. Hong Kong Disneyland attracted about six million guests final 12 months, making it the smallest park in Disney’s portfolio.

It was harrowing sufficient for small companies — the bars, dental care practices, small regulation companies, day care facilities and different storefronts that dot the streets of each American city and metropolis — to have to shut down after state officers imposed lockdowns in March to comprise the pandemic.

But the resurgence of the virus, particularly in states akin to California, Florida and Texas that had begun to reopen, has launched a far darker actuality for a lot of small companies: Their momentary closures would possibly develop into everlasting.

Nearly 66,000 companies have folded since March 1, in accordance to information from Yelp, which supplies a platform for native companies to promote their companies and has been monitoring bulletins of closings posted on its website. Small companies account for 44 % of all U.S. financial exercise, in accordance to the Small Business Administration, and closures on such an immense scale may devastate the nation’s financial progress.

On the final Friday of June, after Gov. Greg Abbott of Texas stated that bars throughout the state would have to shut down a second time as a result of coronavirus instances have been skyrocketing, Mick Larkin determined he had sufficient. He and his accomplice determined to shut their membership, Krank It Karaoke in Wichita Falls, Texas, for good.

“We did everything we were supposed to do,” Mr. Larkin stated. “When he shut us down again, and after I put out all that money to meet their rules, I just said, ‘I can’t keep doing this.’”

Automakers are persevering with to produce automobiles and vehicles at full pace — a minimum of for now.

Fiat Chrysler, Ford Motor, General Motors, Honda, Toyota and different producers are working virtually all of their vegetation within the United States on two or three shifts. But as virus instances rise throughout a lot of the nation, it might develop into troublesome for the businesses to preserve at it.

This week, G.M. will lay off a third shift — about 1,250 employees — at its truck plant in Wentzville, Mo., the place absenteeism has been rising as a result of employees are involved in regards to the unfold of the virus.

Last month, members of the United Automobile Workers union known as on G.M. to shut down a manufacturing unit in Arlington, Texas, in response to the fast unfold of the virus in that state.

Toyota stated it has seen some enhance in coronavirus instances amongst employees at its plant in San Antonio however declined to disclose how many individuals have been sickened.

The virus has unfold quickly in Texas in the previous couple of weeks. The state, which allowed its stay-at-home order to lapse on April 30, has had practically 265,000 instances, and infections have accelerated in latest weeks.

Toyota has idled its vegetation in Alabama, Kentucky, Mississippi and Texas in addition to in Canada this week as a part of a deliberate summer season shut down.

Auto vegetation carry a number of thousand employees collectively below one roof every day. Manufacturers have taken a vary of precautions to forestall infections amongst employees, together with using masks, gloves and face shields. Companies are additionally monitoring the physique temperatures of employees, making time for sanitizing work areas and including obstacles to protect employees who want to work shut to one another to full sure duties.

White House economists stirred an outcry two months in the past once they posted a chart to Twitter that appeared to forecast that American deaths from the coronavirus pandemic would cease by the center of May. The chart was derided by Democrats and lots of economists.

Recreating that chart at present yields a very completely different outcome: a skyrocketing acceleration in each day deaths from the virus.

The economists behind the chart, together with each the then-interim chairman of the White House Council of Economic Advisers and a former chairman of the council, stated in May that it was by no means meant to be learn as a prediction. It was, the financial council said on Twitter, “a curve-fitting exercise to summarize COVID-19’s observed trajectory.”

The economists made their graph by plotting a number of forecasts of the trail of the virus printed over time by researchers at the Institute for Health Metrics and Evaluation at the University of Washington, then including in a curve that was generated by working precise deaths from the virus over time by way of a easy perform in Microsoft Excel: a “cubic fit.”

Today, it’s clear that the trajectory of the virus has taken a flip that the White House fashions didn’t mirror. Infections have shot up throughout the South and Southwest, setting single-day information in states like Arizona, Florida and Texas. Deaths have begun to rebound as properly.

A brand new model of the May chart, generated with the identical method the White House used however up to date to mirror the precise path of virus deaths prior to now two months, now differs sharply from the optimistic image the administration as soon as posted to Twitter. Instead of deaths falling to zero, the “cubic” curve reveals that the development has by no means fallen beneath 500 a day. Most importantly, they’re now rising. And due to how cubic fashions work, the chart reveals deaths climbing increased and better with every passing day, exceeding 3,000 per day by the start of August.

That’s unlikely to occur — identical to it was extremely unlikely in May that the development in deaths meant they might disappear by Memorial Day.

The International Monetary Fund stated on Monday that it was sharply chopping its forecast for financial progress for the Middle East and Central Asia, as Saudi Arabia and different oil exporters within the space are hit by a “double whammy” of oil worth and output cuts and the results of lockdowns.

Oil export income within the area is anticipated to decline by $270 billion, the I.M.F. said. Activities together with tourism, transportation and retail are additionally being hit exhausting by the lockdowns designed to curb the pandemic, it stated.

The fund stated it now anticipated that oil exporters like Saudi Arabia, Kuwait, and the United Arab Emirates would expertise a 7.Three % financial contraction on common this 12 months, down from a 4.2 % contraction predicted in April.

Overall, throughout the huge area stretching from Mauritania and Algeria in North Africa to Turkmenistan and Uzbekistan in Central Asia, the fund predicted the economic system would shrink by 4.7 % in 2020, a 2 share level discount from its April forecast.

The fund additionally warned that downward stress on these economies would carry dangers of “social unrest and political instability” and that there might be “potential renewed volatility” in oil markets, which had seen a partial restoration to about $42 for Brent crude, the worldwide benchmark, after some crude futures contracts fell into unfavourable territory in April.

Despite the sluggish financial efficiency, the fund famous that each increased credit-rated international locations, together with Saudi Arabia and Qatar, and others with decrease rankings, together with Bahrain and Egypt, have to date managed to retain entry to worldwide capital.

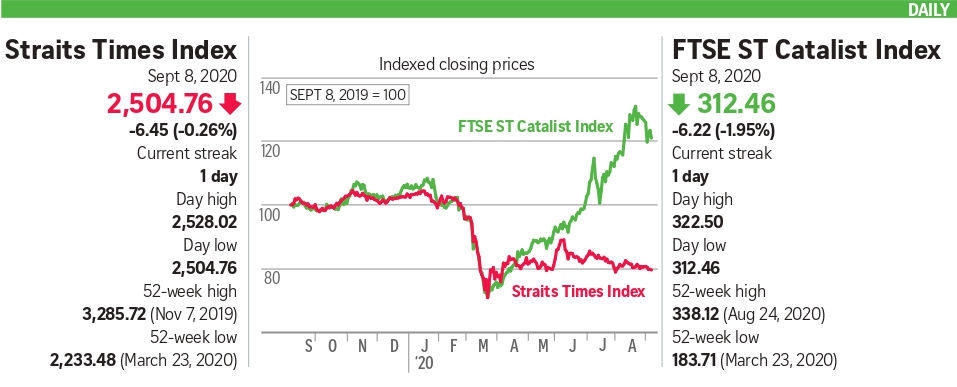

Monday proved to be one other turbulent day for Wall Street, with shares reversing an early achieve that had briefly lifted the S&P 500 again into constructive territory for the 12 months.

The index was practically 1 % decrease by the tip of the day, after earlier having climbed greater than 1.5 %. The unsteady buying and selling got here because the variety of coronavirus instances continued to rise, and traders additionally had the approaching earnings season to contemplate.

Many corporations, rocked by uncertainties brought on by the unfold of the coronavirus, have stopped giving steering on revenue projections by way of the 12 months, so merchants will likely be trying particularly carefully on the quarterly numbers as they’re reported.

On Monday, Pepsico reported higher than anticipated outcomes, partly due to a bounce in gross sales of snack meals. On Tuesday, JPMorgan, Citigroup and Wells Fargo will all report their outcomes, and a vary of different corporations from Netflix to Delta Air Lines will even present updates this week.

Stocks have climbed lately regardless of the unrelenting unfold of the coronavirus in lots of components of the world, however the market has additionally confirmed itself prone to a sudden downdraft if sentiment shifts and traders select to give attention to the dangers to the economic system or income — one thing that might occur if company outcomes are available far weaker than anticipated.

Adding to the market’s jitters on Monday was the information that Gov. Gavin Newsom of California announced one of the most sweeping rollbacks of any state’s reopening plans, saying that he would transfer to shut indoor operations statewide for eating places, wineries, film theaters, zoos and card rooms, and that bars can be drive to shut all operations.

Florida on Sunday reported greater than 15,000 new instances, the best single-day complete by any state because the begin of the pandemic.

The financial disaster is prompting a rising coalition within the United States — together with Democrats and Republicans, labor and enterprise — to push for a new coaching effort to improve the abilities of American employees, creating what one proponent known as “a Marshall Plan for ourselves.”

Now that Independence Day is behind us, tax day is quick approaching.

Because of the coronavirus pandemic, the Treasury Department postponed the normal April 15 federal tax submitting deadline till July 15. And this time, there’s no wiggle room. Last month, the Internal Revenue Service introduced that there wouldn’t be one other blanket submitting delay.

So in the event you haven’t filed your return but — or in the event you’ve filed however haven’t but paid the taxes you owe for 2019 — the deadline is Wednesday.

“It’s just like April 15, but in July,” stated Cindy Hockenberry, director of tax analysis and authorities relations for the National Association of Tax Professionals, a commerce group.

About 142 million taxpayers had filed returns as of July 3, in accordance to I.R.S. statistics, however the company has struggled to course of returns due to diminished staffing through the pandemic. The company had processed about 131 million returns as of July 3 — 10 % fewer than the identical time final 12 months.

And some taxpayers are dealing with lengthy delays in getting the refunds they’re owed, in accordance to a report from Erin Collins, the brand new nationwide taxpayer advocate, who represents filers.

-

The proprietor of New York & Co., the ladies’s attire chain that traces its roots to 1918, filed for Chapter 11 bankruptcy on Monday in U.S. Bankruptcy Court for the District of New Jersey. RTW Retailwinds, which additionally owns the manufacturers Fashion to Figure and Happy x Nature, stated in a assertion that it had about 378 retail and outlet places and “expects to close a significant portion, if not all, of its brick-and-mortar stores.” The firm blamed its chapter on “the combined effects” of a troublesome retail setting and the coronavirus pandemic.

-

Consumers continued to snack on Tostitos and Cheetos through the pandemic, boosting revenues for snacks on the meals big PepsiCo through the second quarter. Total revenues fell 3.1 % within the second quarter to $15.9 billion due largely to a steep drop in gross sales in Latin America and a falloff of revenues in drinks in North America. But these declines have been considerably offset by robust gross sales in chips and snacks in addition to a double-digit climb within the firm’s Quaker Oats cereals and different meals. The firm additionally stated it hopes to develop that enterprise this fall with the discharge of Cheetos Mac ‘n Cheese.

-

REI, the out of doors gear chain, will lay off 400 retail workers by Wednesday because the business continues to battle by way of the pandemic, the corporate stated Friday. The firm’s cuts comply with the elimination of 25 %, or 300 workers, at its headquarters in Kent, Wash., in April.

Be First to Comment