A couple of months in the past most individuals had by no means heard of the STAR Market or its companies. The most precious was AMEC, a low-key Chinese producer of chipmaking instruments with a market capitalisation of round 100bn yuan ($14bn). Other huge members, which make semiconductors (Montage Technology), workplace software program (Kingsoft) or railway electronics (China Railway Signal & Communication), had been largely nameless to Western ears.

That all modified in July. First, Semiconductor Manufacturing International Corporation (SMIC) listed its shares on the board, elevating $6.5bn from the providing. Per week later Ant Group, the funds arm of Alibaba, China’s e-commerce titan, stated it will additionally listing shares there (in addition to in Hong Kong). Ant will be the most precious personal firm on Earth, valued at $150bn or so. That flotation alone might push the STAR Market previous the Nasdaq because the world’s prime venue for tech capital-raising this 12 months. And Ant isn’t alone. Geely, a giant Chinese carmaker; the fintech arm of JD.com, an internet retailer; Imagination Technologies, a British chip designer with Chinese buyers: all are reportedly mulling listings. The bourse already hosts 141 companies. Another 409 are within the strategy of registering.

The STAR Market’s most eye-popping valuations are for corporations whose merchandise are central to the Chinese authorities’s need for an impartial home semiconductor business. Shares of SMIC and AMEC, as an example, commerce at 200 and 500 instances earnings. The common price-to-earnings ratio of STAR 50 companies is a juicy 71, in contrast with 52 for Nasdaq.

By all technical accounts that appears wealthy. Experts contemplate SMIC and AMEC to be behind cutting-edge Western rivals. So how did the STAR Market come from nowhere to change into the world’s largest cash pile for tech in only a 12 months?

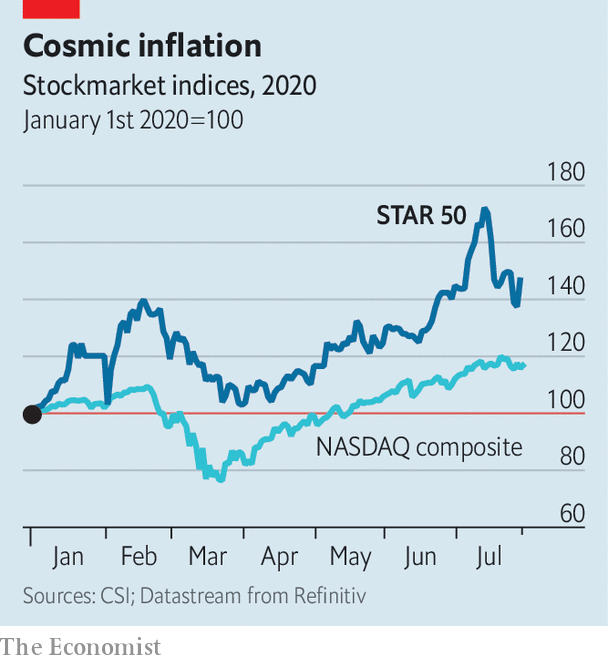

The quick answer is the tussle for technological and financial supremacy between America and China. SMIC delisted from the New York Stock Exchange final 12 months, ostensibly for administrative causes—however looming American laws that would bar Chinese corporations from American exchanges could properly have weighed on its choice, too. An funding within the likes of SMIC or AMEC is, in different phrases, a wager that Beijing’s ambition of semiconductor independence is real looking—and that the Communist Party is not going to enable its champions to fail, even when they may not match high-end international competitors. Judging by the STAR 50 index, up by practically 50% to this point this 12 months (see chart), loads of buyers like these odds.

This article appeared within the Business part of the print version beneath the headline “Wish upon a STAR”

Be First to Comment