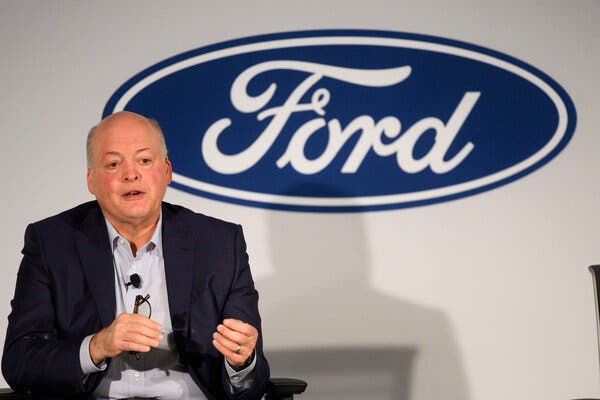

Ford Motor mentioned its chief govt, Jim Hackett, will retire on Oct. 1, ending a three-year run through which the automaker has labored with blended outcomes to streamline its operations and focus its enterprise on electrical vehicles, vehicles and sport-utility autos.

Mr. Hackett, 65, might be succeeded by James D. Farley Jr., who had been named chief working officer in February.

“I am very grateful to Jim Hackett for all he has done to modernize Ford and prepare us to compete and win in the future,” mentioned William Clay Ford Jr., Ford’s govt chairman. The firm, he added, is changing into “much more nimble.”

Mr. Hackett, a former chief govt of Steelcase, an workplace furnishings producer that’s a lot smaller and much less advanced, was named to the highest job at Ford in May 2017, as the corporate’s enterprise was slumping. He promised to revitalize Ford’s operations and steer the corporate towards autos that may generate income and spend money on rising applied sciences like electrical and self-driving autos.

The firm is beginning to introduce among the fashions developed below Mr. Hackett, together with a redesigned F-150 pickup truck and the Mustang Mach E, an electrical S.U.V. styled to resemble the storied sports activities automotive.

But to date the turnaround has had little impact on the corporate’s backside line and inventory value. Ford shares had been buying and selling at about $11 when he arrived. The inventory was buying and selling at about $6.88 Tuesday morning, up greater than 2 p.c after information of the Mr. Hackett’s retirement.

Investors worth Ford at about $27 billion, simply one-tenth the market capitalization of Tesla, the electrical automaker that makes far fewer vehicles and has been round solely since 2003.

Mr. Farley, 58, joined Ford in 2007 from Toyota Motor, and has held a number of jobs, together with working the corporate’s advertising, its European operations and a new enterprise technique group.

European Union authorities on Tuesday introduced an investigation of Google’s $2.1 billion buy of the fitness-tracking firm Fitbit, elevating alarms in regards to the well being information the web large can be buying as a part of the deal.

The inquiry exhibits the elevated scrutiny Google and different massive expertise firms are dealing with from regulators in Europe and the United States about their rising dominance over the digital financial system. Officials have raised considerations that the largest tech platforms purchase up smaller firms to solidify their dominance and restrict competitors.

Margrethe Vestager, the European Commission’s prime antitrust regulator, mentioned a preliminary investigation of the Fitbit deal had raised considerations about how Google would use information collected from Fitbit for its internet advertising providers, a market the place Google is already dominant. The well being and health information could possibly be used to extra narrowly goal advertisements, she mentioned.

“By increasing the data advantage of Google in the personalization of the ads it serves via its search engine and displays on other internet pages, it would be more difficult for rivals to match Google’s online advertising services,” the fee mentioned in a assertion saying the investigation.

Google defended the acquisition, saying it competes with firms like Apple, Samsung and Garmin that supply health monitoring units. “This deal is about devices, not data,” Rick Osterloh, Google’s senior vice chairman for units and providers, said in a blog post. The firm mentioned it might not use Fitbit well being and wellness information for promoting providers and supplied to make a legally binding dedication to the fee to restrict its use of the information.

BP reported a $16.eight billion quarterly loss on Tuesday, and reduce its dividend in half for the primary time because the Deepwater Horizon catastrophe a decade in the past, as decrease oil costs and plunging demand from the results of the coronavirus pandemic took a toll on the London-based vitality large.

At the identical time, the corporate took $17. four billion in write-offs in exploration and different actions, and reduce its forecasts for oil and gasoline costs.

In reducing its dividend to five.25 cents a share, BP mentioned that it might prioritize maintaining the payout at that degree. The firm has beforehand mentioned it might reduce about 10,000 jobs, with the bulk anticipated to depart this 12 months.

On a name with journalists on Tuesday, the corporate’s chief govt, Bernard Looney, outlined an effort to shift BP away from its concentrate on oil to what he known as an “integrated energy company.”

Among the highlights of his presentation: BP will improve its investments in low-carbon vitality, like photo voltaic and wind energy, by tenfold in a decade, whereas reducing its oil and gasoline manufacturing by 40 p.c. He additionally mentioned BP wouldn’t start exploration in any new international locations.

By the top of the last decade, he mentioned, oil and gasoline would make up about half of the corporate’s capital investments, with renewables and different non-oil investments accounting for the remainder.

After months of negotiations, Argentina has reached a cope with its collectors, together with the asset managers BlackRock and Greylock Capital Management, to restructure about $65 billion in international debt, the economy ministry said on Tuesday.

The deal between Argentina and its largest collectors would grant “significant” debt aid to the nation, the ministry mentioned. In May, Argentina missed a bond cost and entered into its ninth default because the nation’s independence and third within the final 20 years.

Under the settlement, collectors might be paid 54.eight cents on the greenback, based on an Argentine authorities official who has taken half within the negotiations who spoke on situation of anonymity to debate personal negotiations.

Argentina would supply collectors new bonds in change for defaulted debt and unpaid curiosity. Investors who maintain euro-denominated and Swiss franc-denominated bonds would additionally be capable of swap these for brand spanking new U.S. dollar-denominated bonds. The settlement additionally consists of adjustments to cost dates.

A spread of outstanding folks, together with Pope Francis, Senator Elizabeth Warren and the Nobel-winning economist Joseph E. Stiglitz, known as on Argentina’s bondholders to come back to a favorable settlement shortly with the cash-strapped nation.

The International Monetary Fund has forecast that Argentina’s financial system will fall practically 10 p.c this 12 months, deepening a yearslong financial disaster which has been compounded by the coronavirus pandemic and extraordinarily excessive ranges of inflation.

BlackRock, the world’s largest asset manger, had rejected an earlier proposal from Argentina and pushed different collectors to additionally maintain out for a higher deal. The authorities and its collectors — the Ad Hoc Group of Argentine Bondholders, the Argentina Creditor Committee and the Exchange Bondholder Group and different traders — had been solely three pennies on the greenback aside on their proposed phrases.

The nation has additionally been in talks with the International Monetary Fund, after restoring ties to the institution with a 2018 bailout. The I.M.F. mentioned Argentina’s debt pile was unsustainable as its foreign money plummeted and financial output saved falling. Martín Guzmán, Argentina’s financial system minister, had instructed native media that he would look to the I.M.F. for an alternate method out of its debt disaster if the talks with personal collectors failed.

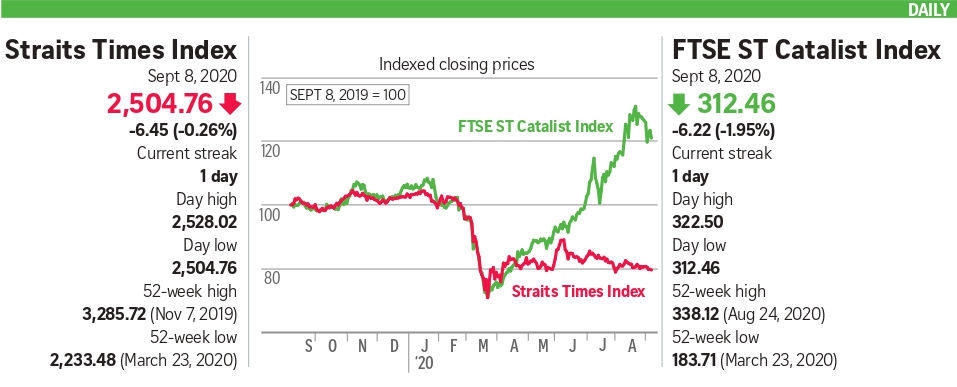

Stocks on Wall Street drifted between positive factors and losses on Tuesday, easing off a rally that had lifted expertise shares to new highs as lawmakers in Washington continued to attempt to pin down a coronavirus aid bundle.

Investors have one eye on company earnings stories, and the opposite on lawmakers who’re discussing the most recent assist invoice to assist folks and companies hit by the financial disaster. Negotiators are set to reconvene on Tuesday, with prime Trump administration officers scheduled to return for an additional assembly with congressional Democrats.

Tens of tens of millions of Americans misplaced essential unemployment advantages on the finish of July and a federal moratorium on evictions has ended. Economists warn that everlasting injury could possibly be wrought on the financial system with out motion.

On the earnings entrance, London-based oil large BP reported a $16.eight billion quarterly loss, and reduce its dividend in half for the primary time in a decade. The firm additionally mentioned it might improve its investments in low-carbon vitality, like photo voltaic and wind energy, by tenfold in a decade, whereas reducing its oil and gasoline manufacturing by 40 p.c. Its shares rose in response, regardless of the large loss.

Tuesday’s pullback comes after a regular climb for shares that has lifted the S&P 500 to inside three p.c of its document. That’s been fueled by authorities spending, the efforts of the Federal Reserve to backstop the financial system, and a surge in shares of expertise shares like Apple, Amazon and Microsoft — which have reported surging income as extra folks work and store from dwelling.

Caterers say they’re taking a monetary beating, with some anticipating their enterprise to be down between 80 and 90 p.c this 12 months. But many really feel higher located than these within the restaurant enterprise. Instead of paying typically costly hire in fascinating areas like most eating places, caterers sometimes pay much less for giant kitchens that may be off the crushed monitor.

Moreover, caterers are typically a nimble group of entrepreneurs, adept at offering finicky brides with their each coronary heart’s whim and overcoming the oddest of logistical challenges. Those traits have helped them in the course of the pandemic.

“We have huge logistical expertise,” mentioned Peter Callahan of Peter Callahan Catering, whose purchasers embrace a few of New York’s wealthiest financiers and whose specialty is mini meals like one-bite cheeseburgers and tiny grilled cheese sandwiches. “When you’re an off-premise caterer, you is likely to be doing an occasion that requires barges to get to a personal island with no autos.

“We’re creative thinkers, and right now people are thinking about how to shape their businesses for the need at hand,” he added.

Holly Sheppard began her Brooklyn catering enterprise, Fig & Pig, in 2011. She was in the course of getting ready a meal for 600 folks in mid-March when the shopper known as, canceling the occasion. After that, the cancellations and postponements rolled in.

With her calendar now largely empty by way of the autumn, Ms. Sheppard gave up the lease on her condominium in Brooklyn, labored out a cope with the owner for her kitchen to pay what she will be able to now and make it up subsequent 12 months, and moved to her home in Tillson, N.Y.

There, she purchased a smoker and is honing her abilities, planning so as to add barbecue to her catering choices.

“I’m going to be a female pitmaster on the roadside in upstate New York until the weddings come back,” Ms. Sheppard mentioned. “I’m going to make it through all of this. Closing isn’t even an option. I’m a scrapper.”

More than 800 craft distillers throughout the United States leapt into motion to assist in the primary wave of the pandemic by producing hand sanitizer, urged on by federal businesses. But with demand for sanitizer fluctuating, distillers have confronted unexpected prices and extra provides that they may not eliminate.

Their conundrum exhibits how life has develop into extra sophisticated because the pandemic has endured. What had been a no-brainer good Samaritan resolution to assist native communities and nurture a new enterprise has as an alternative devolved into a messy monetary calculus because the hardships of the disaster proceed piling up.

“It feels a little bit like no good deed is going unpunished right now,” mentioned Spencer Whelan, the director of the Texas Whiskey Association, a commerce group representing among the state’s distillers.

The prospect of changing liquor income with sanitizer gross sales piqued the curiosity of Jonathan Eagan, the co-owner of the Arizona Distilling Company in Tempe., Ariz. He spent $50,000 on alcohol to provide the disinfectant within the spring, and mentioned he shortly bought sufficient of it to make up for 2 months in misplaced liquor gross sales.

That cash was essential, on condition that bars, eating places and excursions — the distillers’ principal sources of earnings — had been hobbled. But whilst distillers ramped up sanitizer manufacturing, that lifeline additionally began really fizzling out. As panic-buying of the disinfectant leveled off and manufacturing amongst bigger firms stabilized, “the business just kind of dried up” in the previous couple of weeks, mentioned Mr. Eagan.

Now as Arizona offers with new virus circumstances, a lot of his remaining 1,000 gallons of sanitizer has sat idle.

The Federal Aviation Administration on Monday proposed adjustments that Boeing should make to the 737 Max, doubtlessly clearing the best way for the aircraft to begin flying once more by the top of the 12 months.

The adjustments embrace updating the aircraft’s flight management software program, revising crew procedures and rerouting inside wiring. Once formally revealed, the proposal might be open to public remark for 45 days, after which the company will subject a closing ruling.

The company concluded in a associated report revealed on Monday that its proposal was consistent with Boeing’s suggestions. The report mentioned the corporate’s suggestions had sufficiently addressed the issues that contributed to 2 deadly crashes, ensuing within the worldwide grounding of the jet.

“The F.A.A. has preliminarily determined that Boeing’s proposed changes to the 737 Max design, flight crew procedures and maintenance procedures effectively mitigate the airplane-related safety issues that contributed” to crashes in Indonesia and Ethiopia that killed 346 folks, the company mentioned.

The Max has been grounded since March 2019, costing Boeing billions of {dollars}.

Once the F.A.A.’s proposal is official, Boeing can start to make the adjustments and prepared the planes for flight, a course of that would take greater than a week per jet and entails system checks, deep cleansing and software program updates. The firm should try this for a whole bunch of planes that clients have already obtained and a whole bunch extra that Boeing has made however not delivered.

Several different obstacles stay earlier than the F.A.A. lifts its grounding order on the aircraft, together with the event of pilot coaching necessities and the overview and submitting of extra documentation.

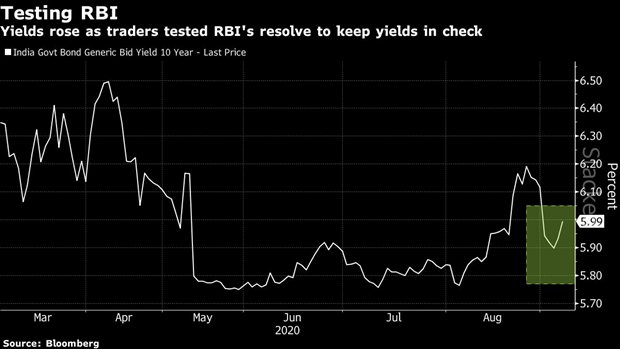

The president of the Federal Reserve Bank of Chicago mentioned the central financial institution had restricted room to do extra and that Congress would wish to help the financial system if the United States confronted a full-fledged second wave of coronavirus infections.

“The punchline ought to be that the ball is in Congress’s court,” Charles Evans, president of the Chicago Fed, mentioned on a name with reporters.

The Federal Reserve reduce its main rate of interest, the federal funds fee, to near-zero in March. Central banks overseas have reduce borrowing prices into damaging territory, however Fed officers have been constantly skeptical that such insurance policies might be efficient.

“We can’t lower the funds rate. Negative interest rates aren’t going to be the tool that we decide to use at this point, or probably at any point,” Mr. Evans mentioned.

The Fed would possibly be capable of use a coverage that may cap sure rates of interest — an strategy generally known as “yield curve control” — however Mr. Evans urged that barely greater medium-term charges aren’t the actual financial drawback. The Fed has the power to supply emergency loans to backstop turbulent markets, however companies and governments would possibly want grants to make it by way of.

“At the moment, it’s really fiscal policy that needs to be addressing this,” he mentioned. Even now, extra congressional help is required to shore up the financial system because the pandemic wears on, Mr. Evans mentioned.

The Chicago Fed chief was not alone in arguing that lately lapsed expanded unemployment advantages ought to be indirectly addressed, as Congress debates the way forward for its pandemic response.

Thomas Barkin, president of the Federal Reserve Bank of Richmond, warned that the pandemic is likely to be creating an financial “sinkhole,” slightly than the pothole policymakers initially believed they had been dealing with. Robert S. Kaplan, president of the Federal Reserve Bank of Dallas, mentioned in an interview on Bloomberg tv on Monday that the insurance policies had helped to bolster shoppers, including that “it’s important that we see an extension of it.”

-

J.C. Penney, the cornerstone of American malls, was the most recent retailer to announce it might not open Thanksgiving Day this 12 months. Other main chains, together with Walmart and Target, have mentioned they’d push the beginning of vacation buying again to Black Friday, typically casting the change as in honor of the work of their front-line workers. J.C. Penney, which filed for chapter in May, said in a statement that the transfer was meant to permit each associates and clients “to stay safe, relax, and enjoy the day.”

-

Websites publishing coronavirus-related misinformation are being supported financially by tapping into web promoting networks owned by Google and Amazon, according to a new Oxford University study. Many of the websites promote merchandise promising to remedy or stop the illness. Even although the websites have a comparatively low viewers, they muddy the data ecosystem and undermine the broader public well being response. One of the researchers mentioned that Google and Amazon ought to contemplate growing a blacklist that blocks web site with a historical past of sharing false and deceptive details about the pandemic.

Be First to Comment