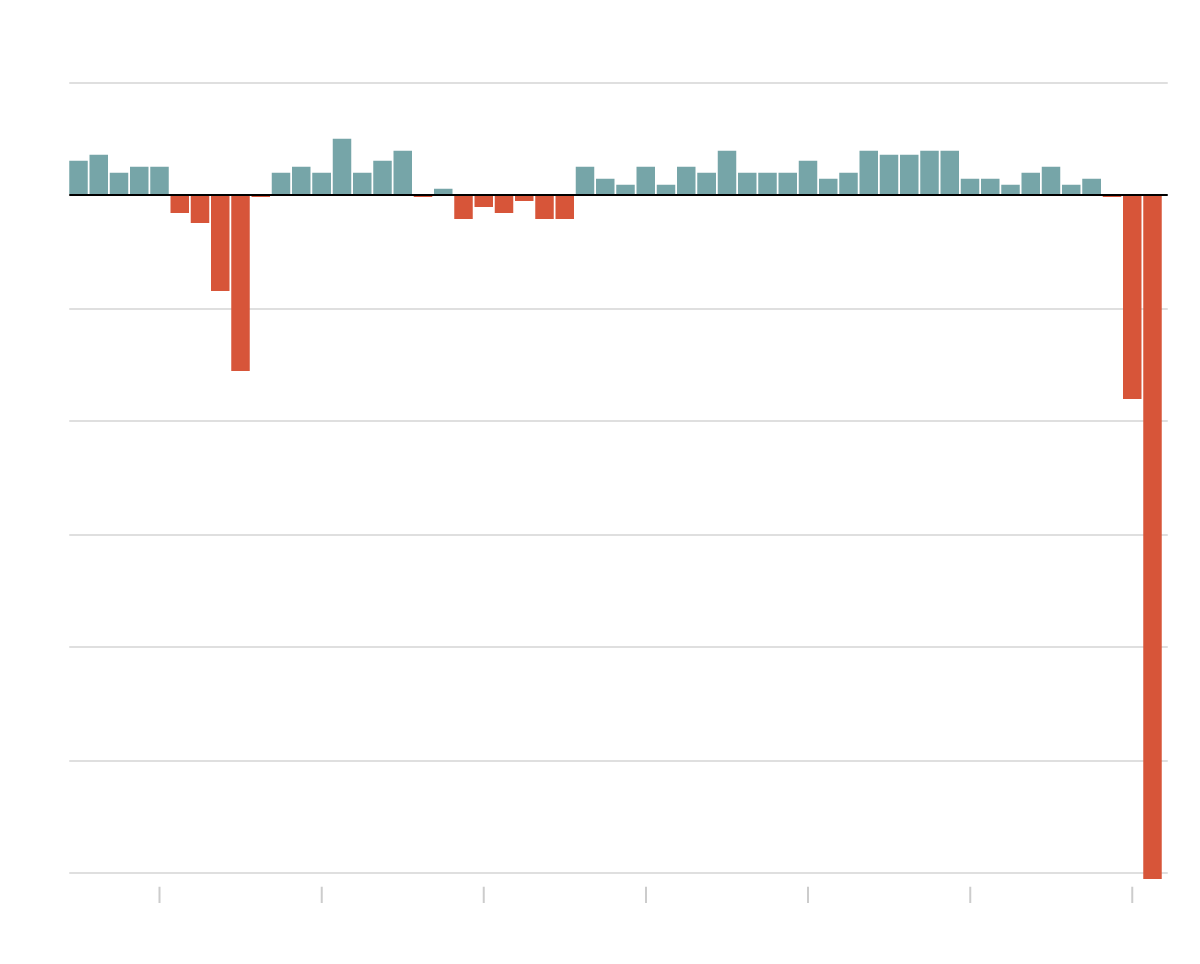

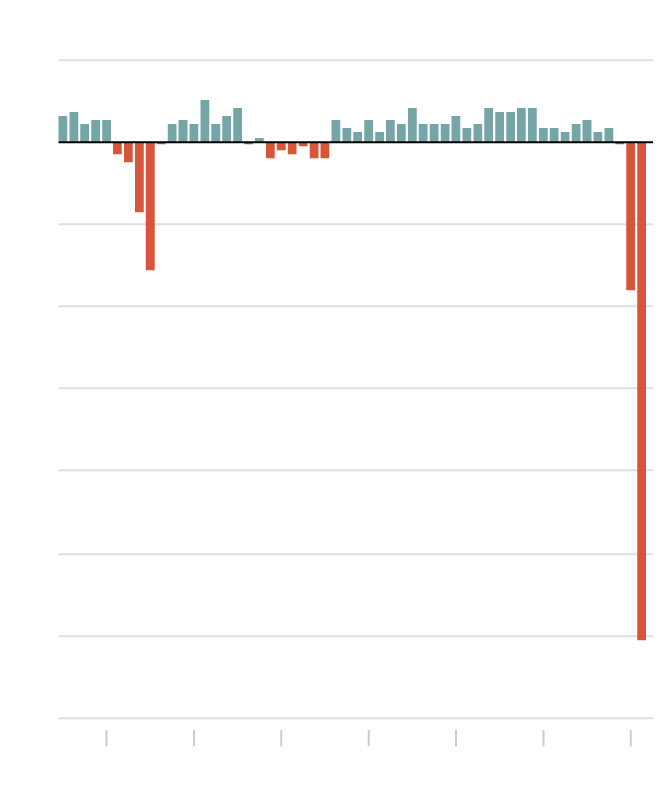

Percentage change from earlier quarter

Percentage change from earlier quarter

The European economic system tumbled into its worst recession on report, as quarantines in international locations throughout the continent introduced enterprise, commerce and shopper spending to a grinding halt within the second quarter.

From April to June, economic activity fell 12.1 p.c from the earlier quarter among the many international locations that use the euro foreign money. It was sharpest contraction since 1995, when the info was first collected, in accordance with Eurostat, the European Union’s statistics company.

Compared to the identical interval a 12 months in the past, the decline was sharper: Economic exercise shrank 15 p.c from the 2nd quarter of 2019.

The collapse marks the extreme financial disruption triggered by the pandemic. Governments ordered lockdowns that silenced many cities, and residents had been instructed to remain residence to forestall the virus’s unfold. On Thursday, the United States introduced its economic system contracted 9.5 p.c within the 2nd quarter in comparison with the earlier three-month interval.

But there are indicators the worst could have handed since then, and {that a} tentative restoration is gaining some traction as European governments unleashed monumental stimulus spending. The prolonged lockdowns have helped curb a widespread resurgence of the pandemic in most international locations.

The information was particularly grim for nations on Europe’s southern rim, which had been among the many worst affected by the virus and which confronted longer quarantine intervals than northern European international locations.

In Spain, which has had one among Europe’s highest loss of life tolls, the economic system shrank by a staggering 18.5 p.c from the earlier quarter. France, the eurozone’s second-largest economic system, shrank by 13.Eight p.c; and Italy, the third-largest economic system within the zone, contracted by 12.Four p.c. France is formally in recession, with three straight quarters of contraction.

On Thursday, the authorities reported that the German economic system, Europe’s largest, shrank by 10.1 p.c from the earlier quarter.

European Union leaders final week agreed to a landmark stimulus of 750 billion euros, or about $884 billion, to rescue their economies and to anchor a gentle turnaround that had began to take maintain after lockdowns started to be lifted.

But dangers abound as surges in new instances are reported, growing the potential of extra quarantines.

“The hard part of this recovery is set to start about now,” Bert Colijn, senior economist for the eurozone at ING Bank, mentioned in a observe to purchasers.

European international locations have, for probably the most half, contained the unfold of coronavirus. But the outbreak, which was early and widespread, has left a deep scar on the area’s economic system: A 12 percent contraction within the second quarter of the 12 months in contrast with the primary quarter. Different authorities interventions and an infection charges means the influence has been uneven. Here are snapshots from the area’s largest economies within the three months that resulted in June.

France

Though France’s 13.Eight p.c decline is stark, a gentle rebound in shopper spending and enterprise exercise after quarantines had been lifted has helped the nation keep away from a far sharper decline. In reality, the nation’s central financial institution lately revised its financial forecasts, anticipating barely much less injury within the subsequent few years.

The authorities’s largess has been key: It spent over 100 billion euros ($118 billion) to pay companies to not lay off employees, it delayed deadlines for enterprise taxes and mortgage funds, and deployed over 300 billion euros in state-guaranteed loans to struggling corporations.

Germany

The 10.1 p.c drop in Germany’s G.D.P., the most important for the reason that nation started conserving quarterly data, would possibly already be portray a darker image of the economic system than is warranted. Separate information launched Thursday confirmed the labor market stabilized in July and surveys of enterprise exercise point out a fast rebound.

But the continuation of this restoration is in danger. Germany was in a greater place than different European Union international locations as a result of the federal government was efficient in containing the unfold of the coronavirus. However, there may be now a rise in new infections as Germans return from holidays overseas, stoking worry of a second wave.

Italy

The devastating financial influence of Italy’s outbreak and lockdown, the primary in Europe, was a 12.Four p.c drop in G.D.P. While the central financial institution estimates that two authorities aid packages mitigated the contraction, a sluggish return in tourism, shopper spending, and enterprise funding is dragging the restoration down.

“At least for Italy, the possibility of a V-shaped recovery is not what we have in front of us,” Bank of Italy’s governor, Daniele Franco, mentioned. One slice of the economic system is experiencing a stronger rebound: industrial manufacturing. During the primary part of the lockdown, which resulted in early May, half of the Italian corporations that had been pressured to close managed to reopen, the central financial institution mentioned.

Spain

Spain’s recession is the deepest of all of the European international locations which have reported second-quarter G.D.P. to this point. The economic system contracted 18.5 p.c in comparison with the primary three months of the 12 months, and the outlook for the remainder of the 12 months is grim. Spain formally ended its Covid-19 state of emergency on June 21, however it has since been fighting a rise within the variety of new instances and over 300 native outbreaks, significantly extreme within the northeast.

Tourism is a considerable part of the Spanish economic system however hopes of a tourism-led financial restoration this summer season have been undermined by quarantine restrictions positioned on the nation and its islands by Britain and different international locations.

Exxon Mobil introduced a record-breaking quarterly lack of $1.1 billion, blaming the coronavirus pandemic for decreasing oil and fuel costs and gross sales volumes.

The outcomes from the most important American oil producer had been additional proof of the deepest downturn for the trade within the trendy period. Oil costs have recovered in latest weeks to round $40 a barrel, however that’s nonetheless roughly a 3rd beneath the oil value of the start of the 12 months.

Chevron, the second largest U.S. oil firm, additionally posted disappointing outcomes for the quarter on Friday and mentioned it was writing off its $2.6 billion funding in Venezuela due to the nation’s political instability and American sanctions in opposition to its authorities.

Exxon’s oil production was down 3 percent and pure fuel output was down 12 p.c, in comparison with the quarter a 12 months in the past, a mirrored image of the crippling of world demand for vitality resulting from a worldwide recession.

Darren W. Woods, Exxon’s chairman and chief government, tried to place the perfect face on the outcomes.

“The global pandemic and oversupply conditions significantly impacted our second quarter financial results,” he mentioned. “We responded decisively by reducing near-term spending and continuing work to improve efficiency. The progress we’ve made to date gives us confidence that we will meet or exceed our cost-reduction targets.”

The $1.1 billion loss compares to a revenue of $3.1 billion a 12 months in the past. At the identical time the corporate’s capital and exploration expenditures had been right down to $5.Three billion from $8.1 billion within the quarter final 12 months.

Chevron mentioned it misplaced $8.Three billion within the quarter; a 12 months earlier it reported a $4.Three billion revenue.

The firm reported an adjusted quarterly lack of $Three billion, excluding one-time gadgets, in comparison with adjusted earnings of $3.Four billion in the identical quarter of 2019. In addition to the $2.6 billion Venezuelan write down, Chevron additionally took a $1.Eight billion write down primarily based on the corporate’s oil and fuel value outlook.

Chevron reported gross sales and different income of $16 billion, in comparison with $36 billion in the identical interval a 12 months earlier.

“We’re focused on what we can control,” Michael Ok. Wirth, Chevron’s chairman and chief government, mentioned in a press release. “We’re transforming our company to be more efficient, agile and innovative.”

Exxon and Chevron mentioned they’d keep their dividends.

Stocks gave up their early beneficial properties on Friday as gnawing considerations concerning the financial toll of the pandemic contended with a surge in income reported by America’s largest tech corporations.

The S&P 500 was barely decrease, after earlier rising about half a p.c. The index continues to be on monitor to finish July with a acquire of about 5 p.c. The index has climbed for 4 consecutive months — rising about 25 p.c for the reason that finish of February.

An enormous issue behind that rally has been the success of huge know-how corporations, which had been effectively positioned to learn from a shift to distant work and limits on public exercise.

On Thursday, buyers heard simply how a lot they benefited. Amazon, Apple and Facebook reported surging income. The blockbuster earnings appeared to briefly put apart the uncertainty and pessimism surrounding the financial influence of the pandemic, but additionally maybe underscored the considerations of lawmakers, expressed on Wednesday, that American’s tech giants have gotten too massive.

Shares of Amazon, Apple and Facebook rose on Friday and lifted the Nasdaq composite. Alphabet, the mum or dad firm of Google, which reported its first-ever decline in quarterly income on Thursday, was decrease.

But the virus continues spreading, and its injury is mounting. On Thursday, the United States reported that its economic system fell 9.5 p.c within the second quarter, in contrast with the earlier quarter, probably the most on report. On Friday, the authorities reported that the eurozone contracted 12.1 p.c within the second quarter. Both the United States and Europe are in deep recessions triggered by shutdowns in financial exercise to curb the unfold of the illness.

Government funds performed a vital position in propping up the American economic system, information launched Friday reveals.

Consumer spending rose 5.6 p.c in June, the Commerce Department mentioned, the second straight month-to-month enhance after a record-setting plunge in April.

But the top of some advantages, particularly the $1,200 cost made to many people, additionally meant that private revenue fell 1.1 p.c final month. Incomes may fall additional now that the federal authorities’s extra unemployment advantages have ended, a minimum of briefly.

To perceive what’s occurring, it helps to return to the start of the pandemic. When companies started shutting their doorways and furloughing employees in March, each incomes and spending fell. Congress then stepped in with a multi-trillion-dollar rescue bundle, which included sending $1,200 checks to most American households and increasing the unemployment insurance coverage system.

As a end result, private incomes rose a report 12.1 p.c in April, regardless of an enormous drop in wage and wage earnings. But spending nonetheless fell, a minimum of partially as a result of individuals had fewer alternatives to buy groceries and dine out. (Other information suggests spending fell sharply among the many rich, whereas rebounding extra rapidly for different revenue teams as soon as authorities checks started arriving.)

In May and June, these patterns started to reverse. Spending picked again up because the economic system reopened. Wage and wage incomes rose too, as corporations started rehiring furloughed employees. Government funds fell with the top of the $1,200 checks, however remained excessive.

The internet end result: Overall private revenue was greater in June than in February. But with out authorities intervention — particularly the expanded unemployment advantages, that are injecting cash into the economic system at a charge of $1.Four trillion a 12 months — incomes can be decrease now than when the disaster started.

Spending has rebounded however stays virtually 7 p.c beneath its precrisis degree, even with the federal government assist. And now, that assistance is at risk of operating out: The $600 per week in further unemployment advantages expires in the present day, and senators have left for the weekend.

United plans so as to add greater than 25 worldwide routes to its September schedule, an indication of restricted optimism in a battered trade at a time when coronavirus instances proceed to rise throughout the nation.

Many of the brand new routes embody locations in Europe and Asia, the place governments prohibit or restrict American guests. United mentioned it will alter its schedule as essential to cope with journey and quarantine restrictions.

“We continue to be realistic in our approach to building back our international and domestic schedules by closely monitoring customer demand and flying where people want to go,” Patrick Quayle, United’s vice chairman of worldwide community and alliances, mentioned in a press release.

Many individuals are nonetheless flying for important enterprise, to go to family and friends or to return residence. Some of the shorter worldwide flights United is including will serve restricted demand for leisure journey.

The airline mentioned it will launch a brand new route connecting Chicago and Tel Aviv if it may receive authorities approval. The airline can even resume service between a few of its American hubs and Amsterdam, Frankfurt, Munich, Sydney, Costa Rica, St. Thomas, Ecuador and a number of other locations in Mexico. United additionally plans to proceed to fly to New Delhi and Mumbai and between Chicago and Hong Kong, pending authorities approval.

Overall, the airline plans to function about 37 p.c of the flights it flew final September, a relative enhance from August. The Transportation Security Administration has solely screened about 26 p.c as many individuals at its checkpoint in latest days because it did on the identical days a 12 months in the past.

The information comes a day after United dealt what seemed to be a deadly blow to ExpressJet, a regional service that operates underneath the United Express model. United has a 49.9 p.c stake in ExpressJet. In a observe to employees on Thursday, ExpressJet’s chief government, Subodh Karnik, mentioned that the 2 airways would work collectively to wind down ExpressJet’s operations after United determined to make one other regional service, CommutAir, the only real operator of United Express flights aboard the small Embraer ERJ145 jet.

A day after lawmakers grilled the chief executives of the most important tech corporations about their dimension and energy, Alphabet, Amazon, Apple and Facebook reported surprisingly wholesome quarterly monetary outcomes, defying one of many worst financial downturns on report.

Even although the businesses felt some sting from the spending slowdown, they demonstrated, as critics have argued, that they’re working on a special enjoying discipline from the remainder of the economic system.

Combined, the businesses reported $28.6 billion in quarterly internet revenue, underscoring how regulatory scrutiny stays extra background noise and a distraction for them reasonably than an imminent menace to their companies.

“The strong continue to get stronger,” mentioned Dan Ives, managing director of fairness analysis at Wedbush Securities. “As many companies are falling by the wayside, the tech stalwarts continue to gain muscle and power in this environment.”

The editors and reporters for the DealBook publication sift via quite a lot of firm reviews and dial into many earnings convention calls. An enormous variety of corporations reported their newest monetary outcomes on Thursday, and except for the tech giants’ bumper income these are a few of the issues that caught our discover, from lapsed cereal eaters to “coronabeards.”

🍺 “To put a finer point in the level of demand we’re seeing, we eclipsed July 4 week shipment days in the United States four times already this year. That’s unheard of.” — Gavin Hattersley, the C.E.O. of Molson Coors

🇯🇵 “We would be in Tokyo right now under normal circumstances. So it’s a total bummer for our company that we don’t have the Olympics.” — Jeff Shell, the C.E.O. of NBCUniversal

🥣 “Special K gained share in quarter two as did Mini-Wheats and Raisin Bran. We are also excited about the consumer trial and rediscovery we are seeing from new and lapsed users in cereal.” — Steven Cahillane, the C.E.O. of Kellogg’s

🧔 “As people go back to work in offices and outside the home, we’ll see a pickup in the wet shave rate.” — David Taylor, the C.E.O. of Procter & Gamble, in response to an analyst query concerning the rise of mullets and “coronabeards” throughout lockdowns

🍩 “I love when we really get on our doughnut mojo, but look, we are leaning into beverages in a big way.” — David Hoffmann, the C.E.O. of Dunkin’ Brands

With Zoom name fatigue setting in and boozy lunches out of the query in the course of the coronavirus pandemic, housebound executives are discovering new methods to satisfy and bond in video video games. The objective is to interrupt up a day that’s filled with get-togethers that typically look, sound and really feel similar.

And for individuals like Lewis Smithingham, an promoting government in Brooklyn, an outing in digital area is an opportunity to kind recollections with individuals he has by no means met, which is an important a part of growing relationships, enterprise and in any other case.

“It’s my golf,” he mentioned. Unlike golf, video video games include social distancing in-built. It is again slapping with out the slapping or the again, splendid throughout a pandemic.

Nobody is aware of what number of executives are assembly in video video games, together with recreation publishers, however examples are popping up on Twitter and different social media platforms.

The concept of holding enterprise conferences in a digital world loved a sure vogue a couple of decade in the past. More than 1,400 organizations had a presence on Second Life, an internet realm with all the things an avatar would wish, together with auditoriums and beer.

For Mr. Smithingham, totally different video games supply benefits for various purchasers. Gunplay and mayhem is just not all the time the fitting match. He is a fan of Animal Crossing: New Horizons, a brand new model of a long-popular Nintendo recreation, which was launched in March.

“My production value is now considerably better in Animal Crossing than it is on Zoom,” he mentioned.

Fiat Chrysler reported a internet lack of 1 billion euros ($1.2 billion) within the second quarter, however mentioned it expects enhancing financial situations to carry its fortunes within the second half of the 12 months.

Forced to close down operations in Europe and North American for a lot of the quarter due to the pandemic, Fiat Chrysler mentioned income dropped 56 p.c, to 11.7 billion euros. It additionally used some 5 billion euros in money.

In a convention name, the automaker’s chief government, Mike Manley, mentioned auto gross sales are recovering sooner than had been anticipated, and the corporate has been capable of ramp manufacturing again to regular ranges in North America. Its European vegetation ought to return to typical manufacturing ranges within the third quarter, the corporate mentioned.

“We expect significant improvement in profitability and cash flows,” he mentioned. “We anticipate a a lot, a lot better second half.

The automaker additionally plans to introduce 5 new electrical automobiles within the coming months, together with plug-in hybrid variations of three totally different Jeep fashions.

Fiat Chrysler is within the strategy of merging with French automaker PSA Group, maker of the Peugeot and Citroën manufacturers. The mixed firm will likely be known as Stellantis.

The Trump administration introduced new sanctions Friday on two Chinese officers and one authorities entity, citing human rights abuses in opposition to predominantly Muslim ethnic minorities within the Xinjiang area in China’s far west.

The sanctions, administered by the Treasury Department’s Office of Foreign Assets Control, successfully minimize the Xinjiang Production and Construction Corps and two of its former officers, Sun Jinlong and Peng Jiarui, off from American property and the monetary system. The Xinjiang Production and Construction Corps is an financial and paramilitary group in control of financial growth within the area.

“The United States is committed to using the full breadth of its financial powers to hold human rights abusers accountable in Xinjiang and across the world,” Steven T. Mnuchin, the Treasury Secretary, mentioned in a press release.

Ties between the United States and China have been fraying because the Trump administration takes an more and more vital posture on China’s dealing with of coronavirus, its rising affect over Hong Kong, its territorial disputes within the South China Sea and its remedy of a largely Muslim minority in Xinjiang.

The Chinese authorities has carried out a marketing campaign of mass detentions in Xinjiang, inserting a million or extra members of Muslim and different minority teams into massive internment camps supposed to extend their loyalty to the Communist Party.

On July 20, the Trump administration added 11 new Chinese entities, together with corporations supplying main American manufacturers like Apple, Ralph Lauren and Tommy Hilfiger, to an inventory that cuts them off from buying American merchandise and not using a particular license, saying the corporations had been complicit in human rights violations in Xinjiang. On July 1, the administration issued a warning to companies with provide chains that run via Xinjiang to think about the reputational, financial and authorized dangers of doing so.

Europe has a foul rep with buyers. For years, asset managers and financial institution strategists have characterised the area by its anemic growth rate and shaky political union, and steered buyers away.

Now, a disaster has changed into an unlikely funding alternative because the area seems to have dealt with the pandemic higher than another elements of the world. In the previous few months, European belongings have staged a comeback, writes Eshe Nelson, who provides two causes for the turnaround:

The euro has gained greater than 5 p.c in opposition to the greenback to this point this 12 months, in accordance with FactSet information. Since late May, Europe’s inventory market has recorded stronger beneficial properties than the S&P 500 index, after taking the energy of the euro under consideration.

Investors are beginning to reap the benefits of the relative cheapness of European equities, however a sustained restoration in both inventory market will depend upon shopper and enterprise confidence returning, which might in flip stir financial exercise.

Here’s a few of what occurred on Thursday that you simply might need missed.

-

Ford Motor mentioned it earned $1.1 billion within the second quarter as a big one-time acquire within the worth of its funding in an autonomous driving firm greater than offset losses in its primary enterprise. Without the acquire, from its stake in Argo AI, Ford misplaced $1.9 billion excluding curiosity and taxes. The end result was higher than Ford’s earlier forecast of a pretax lack of $5 billion.

-

United Airlines warned its pilots that it’d must develop deliberate furloughs if demand for flights remained deeply depressed and a vaccine was not mass produced by the top of subsequent 12 months. The airline beforehand mentioned that it may furlough as much as one third of its pilots, or 3,900 individuals, this 12 months and subsequent.

-

Comcast, the most important cable operator within the U.S., mentioned that Peacock, its new streaming product, attracted 10 million sign-ups in its first three months.

-

California Pizza Kitchen filed for chapter safety in Texas. The firm, which operates greater than 200 places within the United States and internationally, mentioned it will use the restructuring course of to shut unprofitable places and minimize debt, and deliberate to emerge from chapter in lower than three months.

Be First to Comment