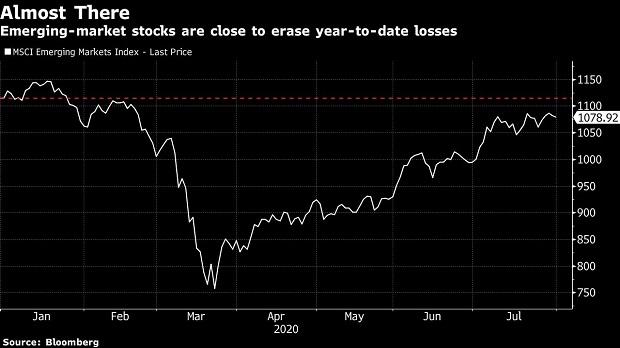

Emerging-market shares and currencies are inside touching distance of erasing their pandemic-fueled losses of 2020. Too dangerous the virus remains to be operating riot, economies are shrinking and central banks are getting low on firepower.

In truth, the backdrop is so grim that traders could quickly begin to take the view that costs are beginning to defy gravity. After falling greater than 30 per cent by March, developing-nation shares as measured by MSCI Inc.’s benchmark index are simply Three per cent beneath the degree at which they began the yr. A gauge of currencies can be Three per cent in need of its 2020 start line, whereas a Bloomberg-Barclays index of native bonds is already again in constructive territory.

The actuality is that currencies have been underpinned by the slide in the US greenback, shares are using the international stimulus wave and bonds are having fun with the enhance supplied by greater than 5,500 foundation factors of interest-rate cuts throughout rising markets since the begin of 2019.

Which makes the begin of August — sometimes one in all the riskiest months of the yr for the asset class — a trigger for nervousness.

“Given the pandemic shows no signs of subsiding, a weak economic tone will almost certainly be carried over to August,” Prakash Sakpal, an economist at ING Groep NV in Singapore, wrote in a report. “Unfortunately, central bank monetary easing to support growth has also reached its limits.”

Activity knowledge due in coming days could assist traders gauge the place the growing world is headed subsequent, as many nations search to get better from durations of government-imposed social isolation. While PMIs from Asia, the area first affected by the Covid-19 pandemic, are anticipated to enhance, exercise knowledge in Chile could underscore the severity of the virus in Latin America, the present hotspot for the illness.

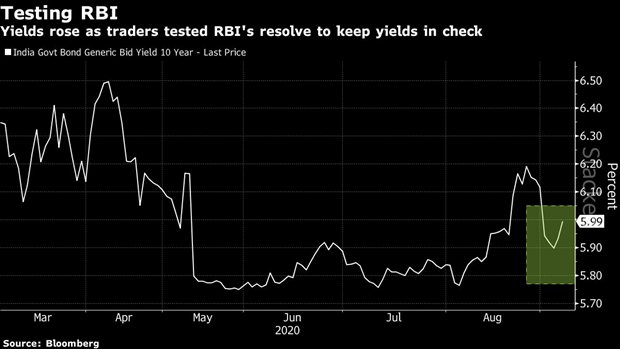

Brazil’s central financial institution is anticipated to chop charges by a quarter-percentage level this week, taking borrowing prices to a file low of two per cent in a bid to assist an economic system devastated by the second-highest variety of Covid-19 instances. Bets on extra easing are much less sure in India, the place coverage makers are weighing the necessity of additional stimulus in opposition to the threat of a rising inflation fee.

Emerging-market shares are near erase year-to-date losses.

Central Bank Meetings

Brazilian coverage makers are anticipated to cut back the key fee on Wednesday to an all-time low of two per cent, in response to the median of economist forecasts compiled by Bloomberg. Industrial manufacturing figures on Tuesday could present perception into how the virus is affecting South America’s greatest economic system.

The Bank of Thailand is more likely to depart charges on maintain on Wednesday, the penultimate assembly for the outgoing governor. Analysts could also be on the lookout for delicate adjustments of coverage tone as a result of, though the incoming Sethaput Suthiwart-Narueput solely takes over on Oct. 1, he’s an current financial coverage board member, doubtlessly giving him extra voice at this week’s assembly. The Thai baht has perked up in the previous week, however is a good distance from making up the floor misplaced since the finish of June as idiosyncratic flows, benign neglect from the central financial institution, and disappointing tourism numbers undercut the forex.

The Reserve Bank of India’s assembly on Thursday hangs in the stability. While the RBI has loads of house for fee cuts and has flagged a willingness to proceed to loosen, it could be involved that inflation has been persistently excessive. Indian bonds have remained in a holding sample in the third quarter, in distinction with the rally seen in Indonesia.

Colombia’s central financial institution will launch assembly minutes on Monday, which can provide perception into the July coverage determination, when officers minimize charges for a fifth straight assembly. Consumer-price figures for July, to be launched on Wednesday, could present a fourth month-to-month decline.

Debt Restructurings

The self-imposed deadline for Argentina to wrap up debt talks on a $65 billion bond-restructuring deal expires Tuesday, although the authorities hasn’t dominated out one other delay. While traders are break up on whether or not to simply accept the nation’s newest provide, Bloomberg Economics sees the most up-to-date authorities proposal as very near the nation’s restrict.

Ecuador pushed its personal deadline for collectors to simply accept phrases of a bond-restructuring provide to Monday, and the outcomes will probably be introduced on Wednesday, with a excessive likelihood of adequate approval, in response to the finance ministry. The postponement got here after GMO and Contrarian Capital Management sued to dam the debt restructuring — which provides traders 91 cents on the greenback — calling it “coercive in the extreme”

Data and Events

Asia’s July PMIs to be launched on Monday are more likely to present additional enchancment, whereas China’s Caixin companies knowledge are more likely to be pretty secure in Wednesday’s studying

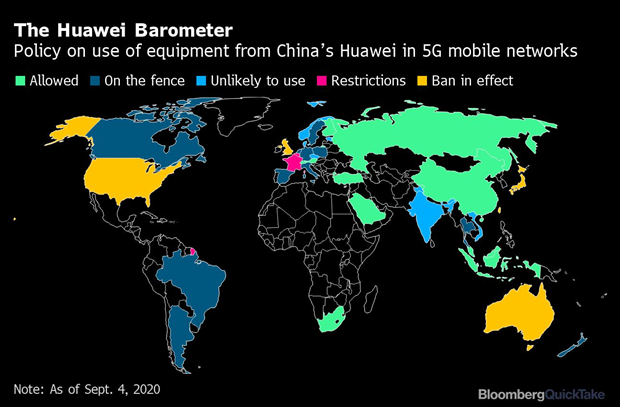

China’s July commerce knowledge could add to optimism about additional restoration in the world’s second-largest economic system. However, the yuan’s appreciation has stalled, partly as the temperature has risen between the US and China

Several Asian nations launch inflation knowledge. Indonesia’s headline inflation to be launched on Monday ought to dip additional beneath the central financial institution’s goal and on Tuesday Korean CPI could rise above zero for the first time since April. On Wednesday, Thai CPI is anticipated to stay adverse in a year-on-year phrases and in Taiwan base results might drive the studying near the zero line versus a yr in the past in knowledge due on Thursday

Philippines will launch a slew of financial knowledge. From Monday onwards, the May remittances quantity could also be launched, which consensus expects to contract 15 per cent. On Wednesday, June commerce numbers and July inflation fee are due and on Thursday second-quarter GDP knowledge could present an additional plunge in exercise

Indonesia will launch second-quarter GDP knowledge on Wednesday, and economists count on a pointy contraction. Indonesian bonds continued to rally final week following one other sturdy public sale, and regardless of information of upper future finances deficits

South Korea’s current-account numbers are due on Thursday

On Friday, traders will monitor Mexico’s July inflation figures for clues on how the virus and measures to offset its financial drag are impacting client costs

A studying of Chile’s financial exercise gauge for June, scheduled for Monday, will in all probability flag a contraction as a lot of the nation remained in a state of lockdown

South Africa’s manufacturing PMI, due Monday, in all probability remained above the 50 degree that signifies enlargement in July, as the economic system rebounds from the Covid-19 hit; PMIs in Poland, Hungary and Russia might also have climbed above the 50 degree after sinking to file lows in May

Russia’s consumer-inflation fee in all probability elevated to three.four per cent in the yr by means of July, from 3.2 per cent the earlier month, knowledge could present Wednesday, in response to the median estimate in a Bloomberg survey

Turkey’s inflation fee in all probability moderated in July to 12.1 per cent from 12.6 per cent, a report could present Tuesday

Be First to Comment