- Risks of Bitcoin value shifting in the direction of $8,2000 within the subsequent quarter are rising, per two traditionally correct technical indicators.

- The benchmark cryptocurrency has been trending downwards in a Falling Wedge sample since June 2020.

- Meanwhile, it has painted a Death Cross that factors to an extra bearish correction out there.

There is a powerful probability of Bitcoin correcting decrease in the direction of $8,200 in Q3/2020. So hints a confluence of two technical indicators.

As of late, Bitcoin is trending inside a “Falling Wedge,” a sample that develops as value tendencies downward whereas leaving a string of decrease lows and decrease highs behind. Meanwhile, the cryptocurrency’s short-term shifting averages have fashioned a Death Cross.

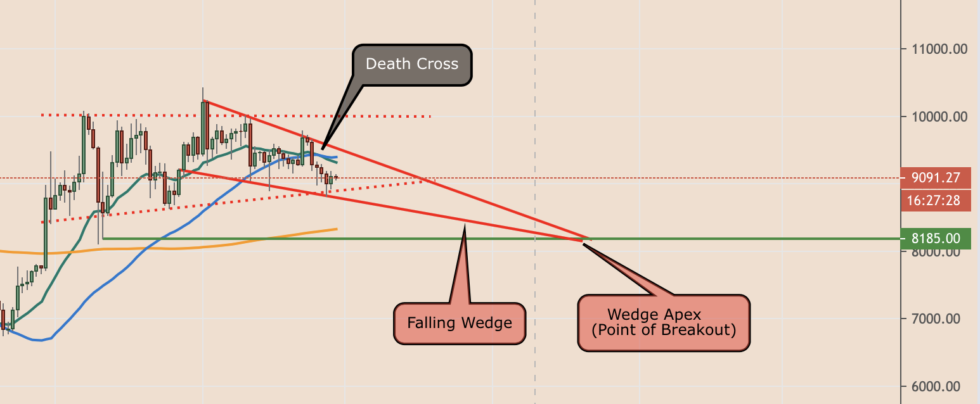

Bitcoin value chart exhibiting a Falling Wedge sample and a Death Cross. Source: TradingView.com

On June 26, Bitcoin’s 50-day easy shifting common crossed above its 20-day exponential shifting common. Traders sometimes see the crossover as an indication of sell-off forward. Part of the reason being the sample’s historic accuracy as a bearish predictor. Each of its earlier occurrences ended up crashing the bitcoin value decrease.

In March 2020, for example, the 50-20 crossover has partially prompted the cryptocurrency to plunge by greater than 50 p.c. Similarly, its prevalence in November 2019 brought about Bitcoin to right downwards by circa 20 p.c.

Confluence

The present fractal exhibits the Death Cross complimenting the Falling Wedge construction. The latter is a bullish indicator that requires an asset to development decrease earlier than trying a breakout to the upside. Chart watchers can take the Death Cross as their cue to maneuver value decrease in the direction of the apex of the Wedge.

That apex, which can possible mature in August 2020, is sitting simply close to $8,200, a stage that served as a powerful help to cap Bitcoin’s draw back makes an attempt in May 2020.

The $8,200-level can be near the cryptocurrency’s 200-DMA. The orange wave, as proven within the chart above, has additionally served as a help stage for bulls not too long ago.

Bitcoin value chart detailed. Source: TradingView.com

If the confluence holds out, then Bitcoin will head decrease in the direction of $8,200 whereas sustaining the Wedge’s vary.

The cryptocurrency could try a pre-mature breakout forward of hitting the apex. That roughly strikes the draw back goal between $8,300 and $8,600, ranges which have withheld a bearish development from flourishing earlier in 2020.

The Bitcoin Bull Case

As the bearish bias looms over, the Bitcoin each day chart is confirming an Ascending Triangle construction. It is a bullish continuation sample that sometimes kinds throughout an uptrend.

Bitcoin value chart exhibiting the formation of a Descending Channel sample. Source: TradingView.com

The end result of an Ascending Triangle sample is normally a breakout above the higher trendline. So far, bitcoin merchants have held their bullish bias above the decrease Triangle trendline. It might imply a bounce again in the direction of $10,000, the extent across the higher Triangle trendline.

A breakout above the Triangle could lead the Bitcoin value to as excessive as $11,500.

Be First to Comment