- Bitcoin eyes a major plunge coming into additional into the third quarter as S&P 500 shares unveil a 45 p.c drop in quarterly income.

- The correlation between the cryptocurrency and the US benchmark index final week hit a report excessive.

- Nevertheless, each the risk-on markets could restrict their draw back transfer on a weakening US greenback outlook.

- Analysts have warned that the dollar might plunge within the coming months.

Bitcoin’s short-term outlook for the third quarter is essentially bearish because of its over-reliance on the S&P 500.

The two benchmarks have tailed every others’ strikes since they dropped in tandem in the course of the March 2020’s world market rout. Especially in current weeks, the correlation between them has grown to report ranges, based on knowledge collected by Skew, a market evaluation platform.

Bitcoin-S&P 500 1-month realized correlation hit report highs. Source: Skew

The S&P 500 is now sitting atop 0.94 p.c year-to-date losses following a circa 43 p.c retracement rally from its March 23 low.

Bitcoin likewise has recovered by greater than 140 p.c from its March 12 nadir. It is now sustaining its YTD features over 27 p.c. Therefore, if the S&P 500 tends to right decrease, as Bitcoinist lined right here, it could enable traders to cowl a part of their losses by promoting Bitcoin, a worthwhile asset to date into the yr.

But regardless of its bearish outlook, Bitcoin traders nonetheless eyes a restricted draw back transfer because of weakening sovereign currencies.

A Risky Dollar

Nic Carter, a companion at Castle Island Ventures, said this week that he sees huge alternatives for Bitcoin as sovereign currencies fail. He cited rising money owed in rising markets that will find yourself immiserating “tens or hundreds of millions of people.”

“And for some of those people, they will be able to use crypto financial rails to exit their sovereign local currency and they can go to Bitcoin,” Mr. Carter added. “They can go to the US dollar.”

But even the dollar is battling a string of weak fundamentals, so say analysts from Credit Suisse, BNP Paribas, Deutsche Bank, and Société Générale. The world reserve foreign money is susceptible to declining within the coming months.

US greenback index is in a free-fall after topping in March 2020. Bitcoin bottomed in the identical month. Source: TradingView.com

Shahab Jalinoos, the worldwide head of international trade technique at Credit Suisse, mentioned that the US greenback may weaken extra from its March 2020 excessive. He cited escalating political and well being dangers within the US, in addition to drastic fee cuts and a flood of liquidity launched by Federal Reserve as key bearish catalysts.

“The stars have aligned for the dollar to weaken more,” Mr. Jalinoos told FT. “The US simply faces more risks than other major economies at this point.”

The greenback can be much less enticing safe-haven for traders engaged in bonds. With charges falling close to zero, there are usually not sufficient yields obtainable on the sovereign bonds. That can be one of many causes behind traders’ shift to dangerous markets like Bitcoin and the S&P 500.

Offsetting Bitcoin Bearish Bias

A weaker outlook for the US greenback could show useful for Bitcoin.

The cryptocurrency has been lengthy touted because the safe-haven in opposition to inflationary fiat belongings. Institutional traders, together with Paul Tudor Jones, have additionally opted to spend money on the cryptocurrency’s derivatives as a measure of insurance coverage in opposition to the Fed’s relentless money-printing.

Bitcoin value has began restoration ever because the US greenback index bottomed. Source: TradingView.com

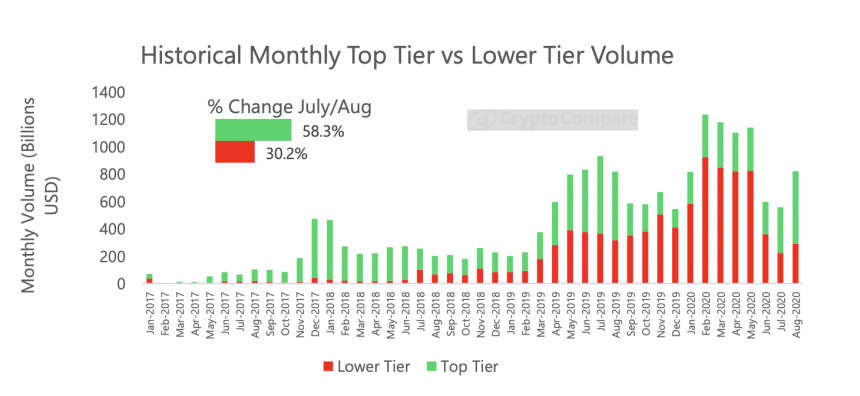

Meanwhile, the S&P 500 is trying to pare a part of its current features as data from FactSet exhibits a 45 p.c plunge in quarterly income. Bitcoin could observe go well with, solely to regain its bullish consciousness in opposition to a essentially weaker greenback outlook.

Be First to Comment