Rising demand for gold that has despatched costs to a nine-year high will enhance Singapore’s export outlook.

The valuable steel has, for many of this yr, bolstered non-oil home exports (Nodx) towards the coronavirus-induced collapse in international demand for items.

Gold spot costs rose above US$1,800 an oz on Wednesday, a day after inflows into exchange-traded funds (ETFs) - largely in North America and Europe - surpassed the annual report set in 2009.

Most ETFs monitor the London Bullion Market Association PM gold value and hold the bodily steel within the type of London Good Delivery bars. So, as extra ETF items are offered, the funds have to enhance the quantity of the bars in bodily gold.

ETFs monitoring the steel have amassed a further 655.6 tons of gold thus far this yr, in accordance to estimates compiled by Bloomberg.

Gold ETF holdings stand at 3,234.6 tons.

That enhance in bodily holdings by funds translated into demand for the valuable steel held in Singapore vaults. Enterprise Singapore mentioned non-monetary gold exports accounted for about 70 per cent of the expansion in March’s Nodx.

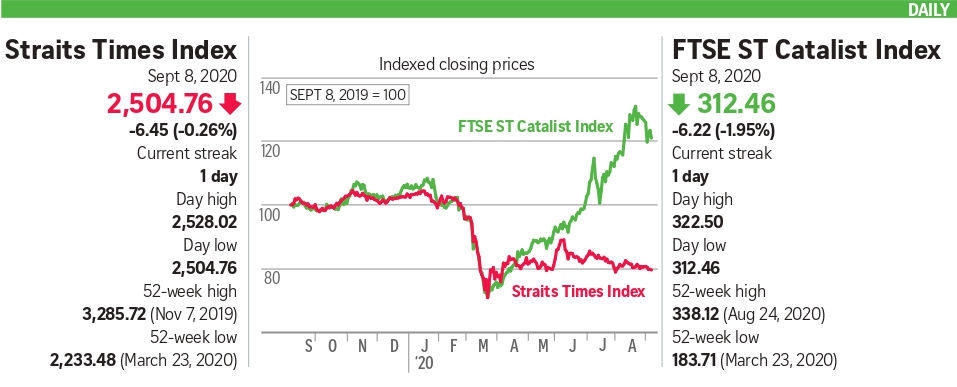

The enhance within the attract of gold additionally helped the inventory market right here by boosting turnover in a interval when most traders had been staying away from new investments.

Singapore Exchange information confirmed that SPDR Gold Shares had been probably the most traded ETFs within the first six months of this yr, and in addition topped different ETFs in one-and three-year whole return - a key valuation for funding choices.

It is no surprise to see gold glowing brighter amid a disaster however the shift within the supply of demand from the East to the West is including to the bullish outlook.

Gold has all the time been considered by traders as a retailer of worth and a secure haven from market turmoil.

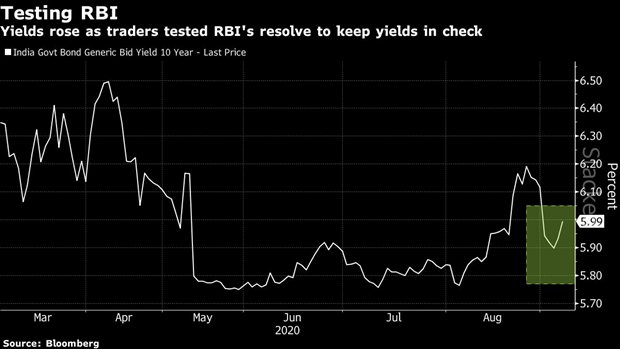

When a recession hits and central banks go on a rate-cut overdrive, a big a part of the standard low-risk bond market turns into nugatory when it comes to yield. Gold turns into the popular different funding for risk-averse traders who nonetheless need to get a return.

Bullion ETFs additionally present a compliance protect for some institutional traders reminiscent of pension funds and insurance coverage corporations that aren’t allowed to maintain bodily gold.

However, the recession brought on by the pandemic has been totally different in some ways from the standard business-cycle slumps.

As nations went into lockdown, retail gross sales of all discretionary gadgets collapsed.

Sales of jewelry, a significant supply of gold demand that made Asia the highest shopper of the yellow steel, was no exception.

But on the identical time, large traders in North America and Europe began to transfer into gold ETFs.

Fear-driven funding demand in developed nations has contributed about 18 per cent to this yr’s achieve in gold costs. Meanwhile, weaker shopping for by emerging-market shoppers resulted in an eight per cent drag, Goldman Sachs estimated in a analysis word final month.

Even because the lockdowns had been being eased, concern of livelihoods endured and have thus far weighed down discretionary shopping for in main gold shopper markets reminiscent of China and India.

Still, secure haven and yield demand for gold in Europe and North America is ready to leap even increased.

Goldman Sachs, as an illustration, set a 12-month value goal of US$2,000 for gold final month, noting that funding demand will doubtless proceed to develop, even because the financial system recovers.

The wager is that whereas most economies will recuperate by the tip of the yr, main central banks will hold rates of interest decrease for longer to preserve solvency of corporations battered by the Covid-19 disaster.

Meanwhile, as Asians achieve extra confidence within the stability of their jobs, they may resume discretionary purchases together with of gold jewelry.

As the 2 traits converge later this yr, gold is probably going to commerce at the next value.

The increased gold demand may additional enhance bullion exports from Singapore.

Be First to Comment