The temper across the globe might need improved in current days, however that did not carry sentiment amongst native traders.

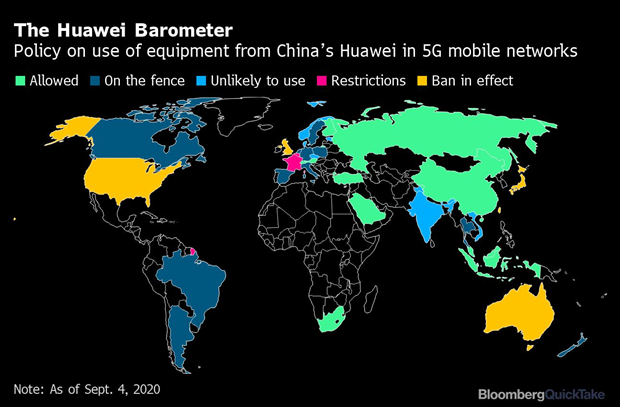

While many merchants had been focusing on the document highs on Wall Street in a single day, souring relations between China and the United States remained on the radar.

The newest salvo out of Washington got here within the type of a warning to schools and universities to promote any Chinese holdings of their endowments owing to proposed guidelines that might see the companies delisted.

US President Donald Trump mentioned on Tuesday that he postponed commerce talks with China initially scheduled for final weekend, including that he “(doesn’t) want to talk to China right now”.

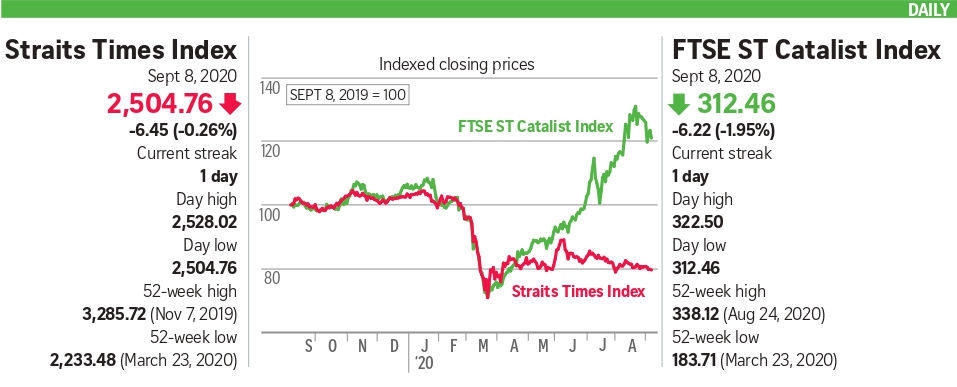

The uncertainty left the Straits Times Index (STI) down 2.05 factors, or 0.08 per cent, at 2,561.04, with losers outnumbering gainers 248 to 171 on commerce of 1.85 billion shares value $1.12 billion.

Wilmar International was the highest gainer, up 1.89 per cent to $4.86. The agri-business group is listed as one among RHB’s prime buys. It famous that Wilmar’s “diversified business with exposure to consumer-pack products helps to offset weakness in other businesses”, and that the potential preliminary public providing of Yihai Kerry Arawana - Wilmar International’s Chinese unit - “by end-2020 is a key catalyst”.

Singapore Airlines was on the backside of the STI’s efficiency desk, declining 2.69 per cent to $3.62. This comes as the group mentioned on Tuesday that travellers from 9 new cities can now transit by Singapore. It can also be rising the frequency of chosen providers in its passenger community over the subsequent three months.

Asian markets equally bucked the development of the Wall Street rally.

The Jakarta Composite Index dipped 0.42 per cent, whereas the benchmark Shanghai Composite dropped 1.24 per cent as China-US commerce tensions proceed to escalate.

The Hang Seng Index eased 0.74 per cent, with buying and selling cancelled within the morning owing to a robust storm within the metropolis.

But Japan’s Nikkei 225 Index ended its two-day decline and rose 0.26 per cent.

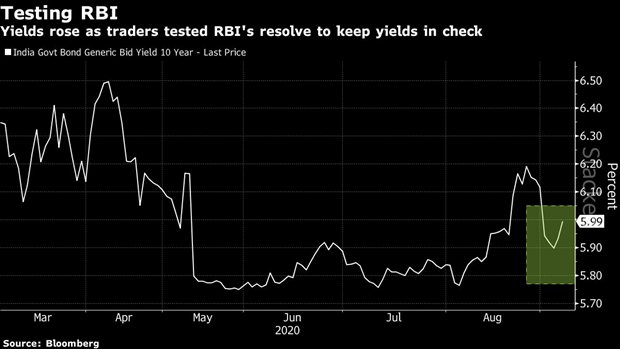

Investors trying to find recent catalysts to danger belongings are holding watch on US fiscal stimulus talks and ready for the Federal Reserve to launch minutes of a July committee assembly, which can give clues about inflation focusing on.

“We have a Federal Reserve that is all in, keeping rates low probably across the curve for as far as the eye can see,” Ms Katie Nixon, chief funding officer at Northern Trust Wealth Management, advised Bloomberg TV. “That is supportive of higher valuations.”

Be First to Comment